Sentry Page Protection

Please Wait...

Retirement Fund Current Model Portfolios

* The current active portfolio is the "Risk-Reduction Level 1" Model Portfolio

Model Portfolio Overview

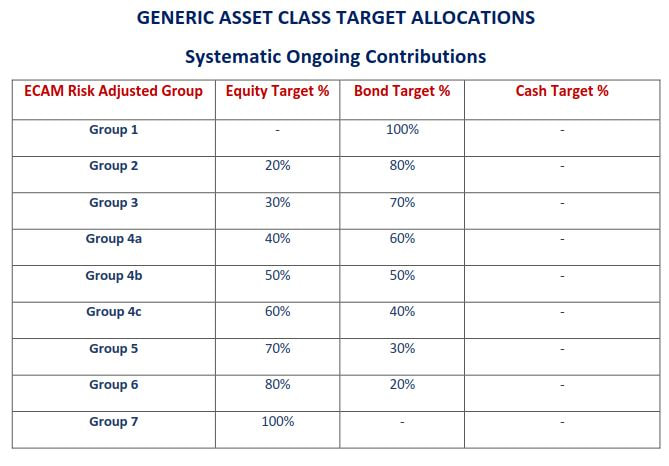

Below is the current asset allocation models for retirement fund accounts. There are 2 distinct model portfolios defined as follows:

- Ongoing systematic contributions: (weekly/monthly/quarterly ongoing investment contributions made at regular intervals within retirement accounts).

- Overall portfolio holdings: (total current funds held within a retirement account)

1. Ongoing Systematic Contributions

Ongoing systematic contribution model allocations typically remain unchanged to take advantage of dollar-cost-averaging during modest-moderate cyclical market corrections. An exception is when:

Two tables are provided:

- a severe bear market decline associated with a recession is indicated as likely, or

- a selected fund has substantially under-performed its peer group over a period of time (at which point it is replaced with another equivalent fund to maintain best-of-breed funds within the models).

Two tables are provided:

- One table for "Generic" ongoing contributions for those investing in portfolios outside the Emirates Group Provident Scheme (EGPS).

- One table for those using the EGPS.

2. Overall Portfolio holdings

Overall portfolio holdings are altered according to indications from our 5-Factor model. There are 4 portfolios aligned in accordance with market conditions:

Two tables are provided:

- Full Risk Model Portfolio

- Risk Reduction Level 1 Model Portfolio (25% equity holdings reduction from full risk)

- Risk Reduction Level 2 Model Portfolio (50% equity holdings reduction from full risk)

- Risk Reduction Level 3 Model Portfolio (75% equity holdings reduction from full risk)

Two tables are provided:

- One table for "Generic" ongoing contributions for those investing in portfolios outside the Emirates Group Provident Scheme (EGPS).

- One table for those using the EGPS.

* NOTE

Our model allocations for each risk group represent a linear increase in risk between the groups and are only designed to act as an allocation model. It is perfectly acceptable to round off allocations (either up or down) as a subscriber feels might be appropriate.

Our model allocations for each risk group represent a linear increase in risk between the groups and are only designed to act as an allocation model. It is perfectly acceptable to round off allocations (either up or down) as a subscriber feels might be appropriate.

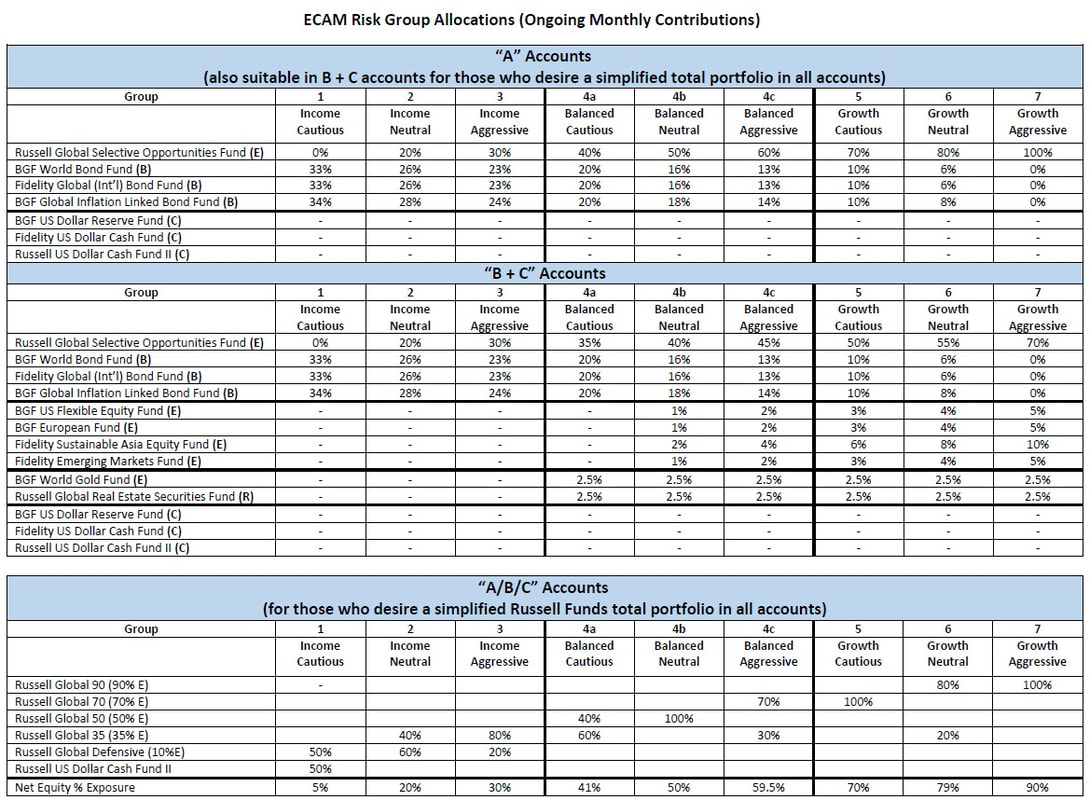

Systematic Ongoing Monthly Contributions

Ongoing model contributions to retirement accounts (weekly/monthly/quarterly) are typically not adjusted as market conditions change. This allows investors to take advantage of "dollar cost averaging" by way of purchasing increased units-per-unit price in a given fund over the decline phase of a complete market cycle.

We conduct a complete review each of the funds within the Emirates Group Provident Scheme (EGPS) quarterly to ensure "best-of-breed" funds are maintained within our model portfolios. The below EGPS allocation model is changed if a given fund has under-performed over a 2-3 year period relative to its peer group. If so, an alternative fund is provided (if available within EGPS).

We conduct a complete review each of the funds within the Emirates Group Provident Scheme (EGPS) quarterly to ensure "best-of-breed" funds are maintained within our model portfolios. The below EGPS allocation model is changed if a given fund has under-performed over a 2-3 year period relative to its peer group. If so, an alternative fund is provided (if available within EGPS).

Emirates Group Provident Scheme (EGPS) Risk Group Adjusted Model

(Systematic Ongoing Contributions)

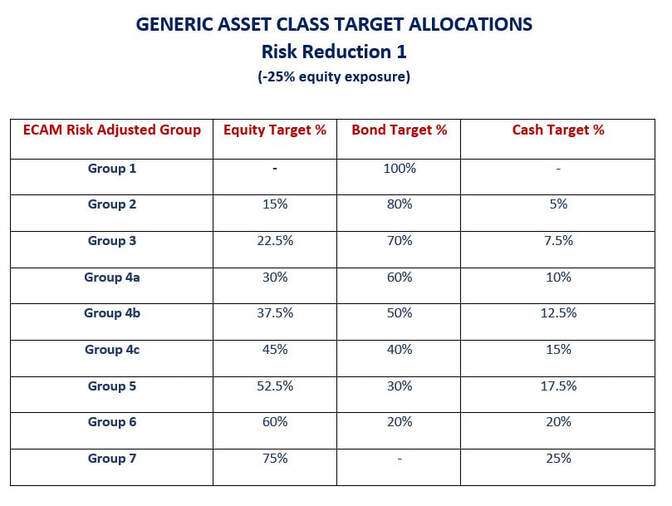

Overall Portfolio Holdings

Overall portfolio holdings are adjusted for risk to protect accrued market returns from potential bear market declines.

Currently the Risk-Reduction Level 1 portfolio is active for Overall Portfolio Holdings. Below is the Generic and Emirates Group Provident Scheme (EGPS) tables.

**Note: Model allocation percentage targets are linear representations of risk reduction. They represent the appropriate equity/bond/cash exposure according to the ECAM Risk Groups and 5-factor model risk assessment output. They are not specific targets that must be met/maintained with precision and should be used as a guide.

- Risk-Reduction Level 1 reduces respective risk group portfolio equity risk by -25% from the full risk model.

- Risk-Reduction Level 2 reduces respective risk group portfolio equity risk by -50% from the full risk model.

- Risk-Reduction Level 3 reduces respective risk group portfolio equity risk by -75% from the full risk model.

Currently the Risk-Reduction Level 1 portfolio is active for Overall Portfolio Holdings. Below is the Generic and Emirates Group Provident Scheme (EGPS) tables.

**Note: Model allocation percentage targets are linear representations of risk reduction. They represent the appropriate equity/bond/cash exposure according to the ECAM Risk Groups and 5-factor model risk assessment output. They are not specific targets that must be met/maintained with precision and should be used as a guide.

Emirates Group Provident Scheme (EGPS) Risk Group Adjusted Model

(Total Portfolio Holdings - Risk Reduction 1)

(Total Portfolio Holdings - Risk Reduction 1)

NOTES:

- When switching from equities into cash attempt to stay within the same fund family (BGF to BGF, Fidelity to Fidelity, Russell to Russell) to avoid excessive delays. Switches between funds within in the same family take 4 business days to complete whereas switching from one fund family to another fund family can take up to 11 business days to complete.

- "B + C Accounts" model maintains Gold and Real Estate Funds as these real asset classes tend to have a negative correlation to equities during modest equity market corrections.

- Russell Multi-asset funds are not adjusted for Risk Reduction Level 1 + 2 as they employ their own risk reduction methodology as part of their allocation process (see below for further information).

Risk Reduction Methodology Overview

The overall portfolio holdings model is adjusted for changing market conditions using our 5-factor model. The model reduces portfolio risk in 3 phases as conditions begin to deteriorate to protect investment capital from severe bear market declines.

- Full Risk 5-Factor model conditions

As our 5-factor model reverts negative our model begins a phased reduction in equities as follows:

Russell fund model holdings are not adjusted as Russell has their own internal risk management process (see description below from their prospectus).

Russell fund model holdings are not adjusted as Russell has their own internal risk management process (see description below from their prospectus).

Russell funds model holdings are adjusted as per below.

* Note: For Russell Funds please see below

- Risk Reduction Level 1 (5-Factor model conditions)

Russell fund model holdings are not adjusted as Russell has their own internal risk management process (see description below from their prospectus).

- Risk Reduction Level 2 (5-Factor model conditions)

Russell fund model holdings are not adjusted as Russell has their own internal risk management process (see description below from their prospectus).

- Risk Reduction Level 3 (5-Factor model conditions)

Russell funds model holdings are adjusted as per below.

* Note: For Russell Funds please see below

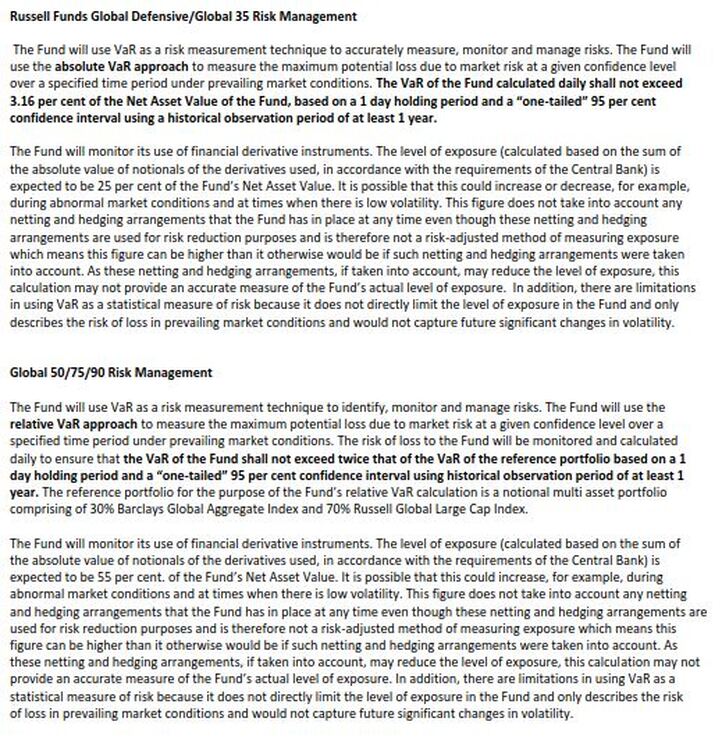

Russell Funds

The Russell family of funds incorporate their own risk management process at the fund-family level utilizing Value-at-Risk (VaR) parameters. Details of the specific methods they utilize are included in the below document copied from their prospectus.

As an overview, Value-at-Risk is a statistical measure of the "riskiness" of a portfolio. It is defined as the maximum dollar amount expected to be lost over a given time horizon, at a predefined confidence level. For example, if the 95% one-month VAR is $1 million, there is 95% confidence that over the next month the portfolio will not lose more than $1 million.

As Russell uses their own internal risk reduction, portfolio models are not altered for Russell funds when conditions warrant a Risk Reduction Level 1 or 2 portfolios. However, we do not believe Russell's risk reduction is sufficient for severe bear market conditions so when Risk Reduction Level 3 conditions are present adjustments are made to model allocations.

Russell Risk Reduction Process

When severe Risk Reduction Level 3 conditions are present, the Russell fund model holdings are reduced by -50% as their VaR risk management process does not adequately protect from severe bear market conditions associated with recessionary conditions.

There are several way to determine VaR:

As an overview, Value-at-Risk is a statistical measure of the "riskiness" of a portfolio. It is defined as the maximum dollar amount expected to be lost over a given time horizon, at a predefined confidence level. For example, if the 95% one-month VAR is $1 million, there is 95% confidence that over the next month the portfolio will not lose more than $1 million.

As Russell uses their own internal risk reduction, portfolio models are not altered for Russell funds when conditions warrant a Risk Reduction Level 1 or 2 portfolios. However, we do not believe Russell's risk reduction is sufficient for severe bear market conditions so when Risk Reduction Level 3 conditions are present adjustments are made to model allocations.

Russell Risk Reduction Process

When severe Risk Reduction Level 3 conditions are present, the Russell fund model holdings are reduced by -50% as their VaR risk management process does not adequately protect from severe bear market conditions associated with recessionary conditions.

There are several way to determine VaR:

- it can be calculated under the parametric method (also known as variance-covariance method) as a function of mean and variance of the returns series, assuming normal distribution.

- with the historical method, VAR is determined by taking the returns belonging to the lowest quintile of the series (identified by the confidence level) and observing the highest of those returns.

- the Monte Carlo method simulates large numbers of scenarios for the portfolio and determines VAR by observing the distribution of the resulting paths.

- Firstly, while quantifying the potential loss within that level, it gives no indication of the size of the loss associated with the tail of the probability distribution out of the confidence level.

- Secondly, it is not additive, so VaR figures of components of a portfolio do not add to the VaR of the overall portfolio, because this measure does not take correlations into account and a simple addition could lead to double counting.

- Lastly, different calculation methods give different results.

Russell Funds VaR Risk Management Process (from published Prospectus)