Sentry Page Protection

Please Wait...

Retirement Fund Determination Process

The Retirement Fund Determination process is composed of 4 steps:

- Complete the Investor Risk Tolerance Questionnaire.

- Determine Risk-Adjusted Asset Allocation.

- Adjust Ongoing Monthly Contributions.

- Adjust total Portfolio Holdings.

1) Investor Risk Tolerance Questionnaire

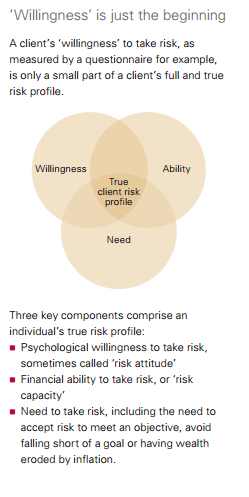

A major starting point in correct asset allocation is an understanding of one's true risk profile. A true risk profile is composed of 3 distinct "legs":

Risk tolerance is an investor’s willingness to take risk and be comfortable with it. It is a behavioral trait that varies across investors but is relatively stable for individual investors.

Risk capacity is the ability to take risk based on their financial situation, and it varies as an investor’s financial situation changes. Generally, more wealth, higher income, and lower liquidity needs indicate a higher risk capacity.

Risk need is the amount of risk necessary to achieve financial goals. If two investors in similar situations both need to reach one million dollars in savings and are starting with account balances of $500,000 and $900,000, the risk need for the first investor will be higher.

Each of the 3 legs must be met in order to have a true profile and accordingly adjusted investment portfolio.

- Risk Tolerance: psychological attitude towards risk taking.

- Risk Capacity: financial ability to take risk.

- Risk Need: financial requirement (need) to take risk.

Risk tolerance is an investor’s willingness to take risk and be comfortable with it. It is a behavioral trait that varies across investors but is relatively stable for individual investors.

Risk capacity is the ability to take risk based on their financial situation, and it varies as an investor’s financial situation changes. Generally, more wealth, higher income, and lower liquidity needs indicate a higher risk capacity.

Risk need is the amount of risk necessary to achieve financial goals. If two investors in similar situations both need to reach one million dollars in savings and are starting with account balances of $500,000 and $900,000, the risk need for the first investor will be higher.

Each of the 3 legs must be met in order to have a true profile and accordingly adjusted investment portfolio.

The Investor Risk Tolerance Questionnaire is designed to give each individual investor insight into their psychological financial risk tolerance. The questionnaire we use is that utilized by Vanguard (one of the world's largest investment companies with more than 20 million investors in 170 countries with $4 trillion in global assets under management). The information provided is 100% confidential and forwarded to our private Microsoft one-drive account where we can review your scoring and advise you accordingly.

To access the questionnaire click on the below magenta-colored link:

* Investor Risk Tolerance Questionnaire Access Link

It is useful to think of the questionnaire as a measure of an individual's "financial pain threshold". Each individual has a unique financial pain threshold based upon a variety of personal factors and, as such, each individual needs to assess as accurately as possible his/her personal threshold. Note the term "pain-loss threshold" was not used as being underweight growth assets over time (and therefore not maximizing retirement account returns over time resulting in much lower final account values than desired/required) can also be very painful (though it is generally accepted in investment psychology a financial loss is twice as painful as not participating in a financial gain).

Once you have completed the risk tolerance questionnaire we will be able to advise you of your unique financial risk tolerance scoring and assign you one of 7 Risk Groups (details below). This is vital to allow individuals to select portfolios tailored for each individuals unique tolerance for risk.

Investors are categorized into 3 distinct investor types further subdivided into various risk categories with associated portfolio mixes:

To access the questionnaire click on the below magenta-colored link:

* Investor Risk Tolerance Questionnaire Access Link

It is useful to think of the questionnaire as a measure of an individual's "financial pain threshold". Each individual has a unique financial pain threshold based upon a variety of personal factors and, as such, each individual needs to assess as accurately as possible his/her personal threshold. Note the term "pain-loss threshold" was not used as being underweight growth assets over time (and therefore not maximizing retirement account returns over time resulting in much lower final account values than desired/required) can also be very painful (though it is generally accepted in investment psychology a financial loss is twice as painful as not participating in a financial gain).

Once you have completed the risk tolerance questionnaire we will be able to advise you of your unique financial risk tolerance scoring and assign you one of 7 Risk Groups (details below). This is vital to allow individuals to select portfolios tailored for each individuals unique tolerance for risk.

Investors are categorized into 3 distinct investor types further subdivided into various risk categories with associated portfolio mixes:

Income Investors (Risk Group 1-3):

Balanced Investors (Risk Group 4a, 4b, 4c):

Growth Investors (Risk Group 5-7):

- Primary Goal: Strong capital preservation

- Secondary Goal: Modest portfolio gain

Balanced Investors (Risk Group 4a, 4b, 4c):

- Primary Goal: Moderate portfolio gain

- Secondary Goal: Moderate capital preservation

Growth Investors (Risk Group 5-7):

- Primary Goal: Strong portfolio gain

- Secondary Goal: Modest capital preservation

Group 1 – Income-Cautious Investors: [Normalized score 7-22]

Group 2 – Income-Neutral Investors: [Normalized score 23-28]

Group 3 – Income-Aggressive Investors: [Normalized score 29-35]

Group 4 – Balanced Investors [Normalized score 36-54]

Group 5 – Growth-Cautious Investors: [Normalized score 55-61]

Group 6 – Growth-Neutral Investors: [Normalized score 62-68]

Group 7 – Growth-Aggressive Investors: [Normalized score 69-79]

- Income-Cautious investors typically have very low levels of knowledge of financial matters and very limited interest in keeping up to date with financial issues. They are unlikely to have experience of investment beyond bank and building society accounts. In general, Income-Cautious investors prefer knowing that their capital is safe rather than seeking high returns. They are not comfortable with the thought of investing in the stock market and would rather keep their money in the bank. Income-Cautious investors usually avoid anything that looks like a gamble. They can take a long time to make up their mind on financial matters and will usually suffer from severe regret when their decisions turn out badly.

Group 2 – Income-Neutral Investors: [Normalized score 23-28]

- Income-Neutral investors typically have low levels of knowledge about financial matters and limited interest in keeping up to date with financial issues. They may have some limited experience of investment products, but will be more familiar with bank and building society accounts than other types of investments. In general, Income-Neutral investors do not like to take risk with their investments. They would prefer to keep their money in the bank, but would be willing to invest in other types of investments if they were likely to be better for the longer term. Income-Neutral investors prefer certain outcomes to gambles. They can take a relatively long time to make up their mind on financial matters and can often suffer from regret when decisions turn out badly.

Group 3 – Income-Aggressive Investors: [Normalized score 29-35]

- Income-Aggressive investors typically have low to moderate levels of knowledge about financial matters and quite limited interest in keeping up to date with financial issues. They may have some experience of investment products, but will be more familiar with bank and building society accounts than other types of investments. In general, Income-Aggressive investors are uncomfortable taking risk with their investments, but would be willing to do so to a limited extent. They realize that risky investments are likely to be better for longer-term returns. Income-Aggressive investors typically prefer certain outcomes to gambles. They can take a relatively long time to make up their mind on financial matters and may suffer from regret when decisions turn out badly.

Group 4 – Balanced Investors [Normalized score 36-54]

- 4a) Balanced-Cautious Investors: [Normalized score 36-41]

- 4b) Balanced-Neutral Investors: [Normalized score 42-48]

- 4c) Balanced-Aggressive Investors: [Normalized score 49-54]

- Balanced investors typically have moderate to good levels of knowledge about financial matters and will pay some attention to keeping up to date with financial matters. They typically have some experience of investment, including investing in products containing risky assets such as equities and bonds. Their degree of familiarity with risky assets along with their investment time horizon defines their categorization (Balanced-Cautious, Balanced-Neutral, Balanced-Aggressive). In general, Balanced investors understand that they have to take investment risk in order to be able to meet their long-term goals. They are likely to be willing to take risk with at least part of their available assets. Balanced investors will usually be prepared to give up a certain outcome for a gamble provided that the potential rewards from the gamble are high enough. They will usually be able to make up their minds on financial matters relatively quickly, but do still suffer from some feelings of regret when their decisions turn out badly.

Group 5 – Growth-Cautious Investors: [Normalized score 55-61]

- Growth-Cautious investors typically have moderate to high levels of financial knowledge and will usually keep up to date on financial issues. They will usually be fairly experienced investors, who have used a range on investment products in the past. In general, Growth-Cautious investors are willing to take on investment risk and understand that this is crucial in terms of generating long-term return. They are willing to take risk with a substantial proportion of their available assets. Growth-Cautious investors will usually take gambles where they see the potential rewards as being attractive. They will usually be able to make up their minds on financial matters quite quickly. While they can suffer from regret when their decisions turn out badly, they are usually able to accept that occasional poor outcomes are a necessary part of long-term investment.

Group 6 – Growth-Neutral Investors: [Normalized score 62-68]

- Growth-Neutral investors typically have high levels of financial knowledge and keep up to date on financial issues. They will usually be experienced investors, who have used a range on investment products in the past, and who may take an active approach to managing their investments. In general, Growth-Neutral investors are happy to take on investment risk and understand that this is crucial in terms of generating long-term return. They are willing to take risk with most of their available assets. Growth-Neutral investors will readily take gambles where they see the potential rewards as being attractive. They will usually be able to make up their minds on financial matters quickly. While they can suffer from regret when their decisions turn out badly, they are able to accept that occasional poor outcomes are a necessary part of long-term investment.

Group 7 – Growth-Aggressive Investors: [Normalized score 69-79]

- Growth-Aggressive investors typically have very high levels of financial knowledge and a keen interest in financial matters. They may be considered as ‘hobby investors’. They have substantial amounts of investment experience and will typically have been active in managing their investment arrangements. In general, Growth-Aggressive investors are looking for the highest possible return on their capital and are willing to take considerable amounts of risk to achieve this. They are usually willing to take risk with all of their available assets. Growth-Aggressive investors can easily be persuaded to take a gamble rather than a certain outcome and enjoy gambling as an activity. They have firm views on investment and will make up their minds on financial matters quickly. They do not suffer from regret to any great extent and can accept occasional poor outcomes without much difficulty.

2) Risk-Adjusted Asset Allocation

Having discovered your unique financial risk tolerance, you will see below the corresponding suggested risk-adjusted percentage allocation to assets versus safer as suggested allocations as suggested by your specific risk tolerance group.

The Risk Tolerance grouping is designed to indicate the "ideal" recommended target exposure to growth assets based upon the risk tolerance score assigned following the completion of the questionnaire.

The Risk Tolerance grouping is designed to indicate the "ideal" recommended target exposure to growth assets based upon the risk tolerance score assigned following the completion of the questionnaire.

|

Group

1 2 3 4a 4b 4c 5 6 7 |

Risk Score

7-22 23-28 29-35 36-41 42-48 49-54 55-61 62-68 69-79 |

Target % Equities

0% 20% 30% 40% 50% 60% 70% 80% 100% |

Target % Bonds

100% 80% 70% 60% 50% 40% 30% 20% 0% |

Portfolio Characteristics

Income Balanced Growth |

It is interesting to note another risk profiling company (FinaMetrica) has found that in their studies of over 500,000 individuals, only 7% of investors can stand to have more than 75% of their total investments in stock and only 1% can handle more then 87% during significant market downturns.

In addition, through our personal experience with subscribers, it is interesting to note approximately 80% of all members fall into the Group 4b/4c and Group 5 range. As such, the above portfolio percentage growth matrix is based upon a range of holdings that ECAM will not normally deviate outside of when adjusting for market factors (except for potential bear market triggers where equity funds are sequentially moved into cash as discussed below).

3) ECAM Portfolio Allocation Models

In line with the above methodology, ECAM recommends utilizing a dual strategy for managing retirement fund accounts. The strategy is divided into 2 management methodologies:

- Ongoing recurrent contribution to retirement plans (weekly/monthly/quarterly contributions); and

- Total portfolio holdings within retirement plans.

1. Ongoing Recurrent Contributions

It is recommended to set your ongoing recurrent asset allocation strategy in accordance with your ECAM Risk Adjusted Asset Class Target allocation model. These allocations are used for all ongoing monthly recurrent purchases and remain unchanged irrespective of changing market conditions to provide systematic accumulation of mutual fund units over long periods of time through Dollar Cost Averaging (clicking on the link for further information).

For those who are members of the Emirates Group Provident Scheme (EGPS), each quarter ECAM completes an extensive review of all the funds available within the EGPS fund universe. The purpose of this review is to ensure the "best of breed" funds are recommended to members. These recommended funds are published as part of our models.

The only time it is recommended to change your recurrent allocations is if our quarterly review indicates a given fund is no longer considered "best of breed". If so we advise accordingly and publish an updated suggest funds list.

The only time it is recommended to change your recurrent allocations is if our quarterly review indicates a given fund is no longer considered "best of breed". If so we advise accordingly and publish an updated suggest funds list.

2. Total Portfolio Holdings

Unlike the ongoing recurrent contributions (which are not adjusted for market conditions), total portfolio holdings are adjusted for changing market conditions to protect investment capital from severe bear market declines (thereby delivering absolute returns over complete market cycles).

ECAM adjusts the risk adjusted model portfolios for 5 Factors that ultimately determine the success of absolute return. The 5-Factor model adjustments are:

Each of the models incorporates a number of inputs. The corresponding "traffic-signal light" gives a quick indication of the extent to which each model has determined its specific risk adjustment to the final portfolios.

The adjustments will "tilt" the final ECAM portfolios towards the upper or lower range of the respective risk tolerance adjusted portfolios as market conditions change. In addition, should the various models indicate a high probability of a bear market decline from overvalued conditions, each portfolio group is moved 75% from equities into cash irrespective of risk group until the models indicate a return to bull market conditions.

NOTE:

Our model portfolios are optimized according to market conditions and investor risk tolerances. Those wishing to keep their portfolio allocations simple may want to use the "A" Account model positions for their B/C accounts as well. Those who prefer to manage their portfolios in greater detail may wish to use a Core/Satellite allocation which is included in each of the models.

- Economic Model (Monetary conditions, Economic conditions and Inflation)

- Fundamental Model (Valuation)

- Technical Model (Trend and Momentum)

- Sentiment Model

- U.S. Liquidity and Economic Stress

Each of the models incorporates a number of inputs. The corresponding "traffic-signal light" gives a quick indication of the extent to which each model has determined its specific risk adjustment to the final portfolios.

The adjustments will "tilt" the final ECAM portfolios towards the upper or lower range of the respective risk tolerance adjusted portfolios as market conditions change. In addition, should the various models indicate a high probability of a bear market decline from overvalued conditions, each portfolio group is moved 75% from equities into cash irrespective of risk group until the models indicate a return to bull market conditions.

NOTE:

Our model portfolios are optimized according to market conditions and investor risk tolerances. Those wishing to keep their portfolio allocations simple may want to use the "A" Account model positions for their B/C accounts as well. Those who prefer to manage their portfolios in greater detail may wish to use a Core/Satellite allocation which is included in each of the models.

Economic Model

The Economic model assesses both the direction and strength of economic activity globally. It serves as an "early warning signal" of potential recession. Given the worst equity market declines occur during times of recession, it is important to monitor global economic data to ascertain the probability of recession at any given point in time.

The inputs to the Economic Model include the following:

The inputs to the Economic Model include the following:

- Industrial Production

- Real Personal Income (excluding transfer payments)

- Non-farm Employment

- Real Retail Sales

- Real Interest Rates

- Inflation

- OECD Composite Leading Index

- JP Morgan Global Composite Purchasing Managers Index

Fundamental & Valuation Model

The Fundamental model assesses the current price structure of US equities (the S&P 500 index) to determine the degree of undervalue/fair value/overvalue currently present.

The degree to which a market is overvalued/undervalued determines not only potential returns but also potential declines.

The inputs to the Fundamental model include the following:

The degree to which a market is overvalued/undervalued determines not only potential returns but also potential declines.

The inputs to the Fundamental model include the following:

- Total Market Capitalization:GDP

- Shiller P/E 10

- S&P 500 Price to Operating Earnings

- S&P 500 Price to Sales Ratio

Technical Model

The Technical model assesses a large number of technical indicators to determine the technical structure of global equities on a daily, weekly and monthly basis.

A total of 24 indicators are used to provide a complete technical picture of equity markets to determine trend, momentum and breadth.

A total of 24 indicators are used to provide a complete technical picture of equity markets to determine trend, momentum and breadth.

Sentiment Model

The Sentiment model assesses the degree to which equity markets are overbought/oversold. Excessive optimism usually is associated with market tops and excessive pessimism is usually associated with market bottoms. As such, sentiment is used as a contrarian market indicator.

During bull markets excess optimism can be used to forecast short term tops whereas excessive pessimism can be used to forecast short term bottoms.

The inputs to the Sentiment model include the following:

During bull markets excess optimism can be used to forecast short term tops whereas excessive pessimism can be used to forecast short term bottoms.

The inputs to the Sentiment model include the following:

- Ned Davis Research (NDR) Crowd Sentiment Poll

- NDR Daily Trading Sentiment Composite

- CNN Money Fear & Greed Index

- Citigroup Panic/Euphoria Index

- Sentiment Trader daily sentiment

- NYSE Put/Call ratio

Liquidity (Economic Stress) Model

The economic stress model is composed of 4 unique stress measure published by 4 different regional U.S. Federal Reserve Banks:

1) Cleveland Federal Reserve Bank Stress Index

2) St. Louis Federal Reserve Bank Financial Stress Index

3) Chicago Federal Reserve Bank National Financial Conditions Index

4) Kansas City Federal Reserve Bank Financial Stress Index

1) Cleveland Federal Reserve Bank Stress Index

2) St. Louis Federal Reserve Bank Financial Stress Index

3) Chicago Federal Reserve Bank National Financial Conditions Index

4) Kansas City Federal Reserve Bank Financial Stress Index