Interactive Brokers Linked Trading Account Overview

Over the years the #1 question asked of ECAM has been "how do you manage your own investment accounts”?

For the past 6 years ECAM has been actively trading a proprietary strategy in their own brokerage accounts. The strategy is a combination of a 60% weighting in the ECAM Multi-Asset Trading Strategy and a 40% weighting in the Maximum Return Trading Strategy (for information on each of the strategies click the magenta links here and here to be taken to the descriptions page).

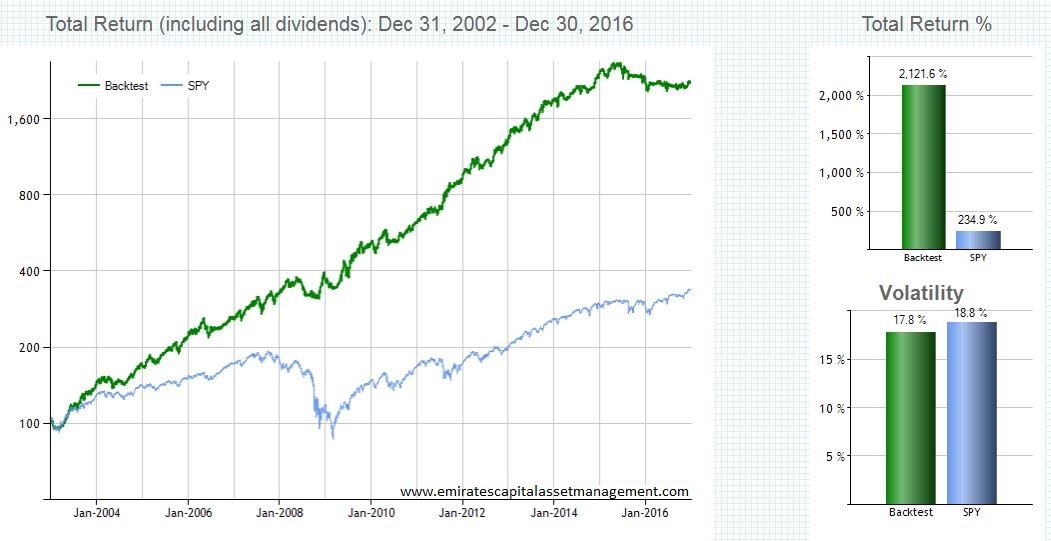

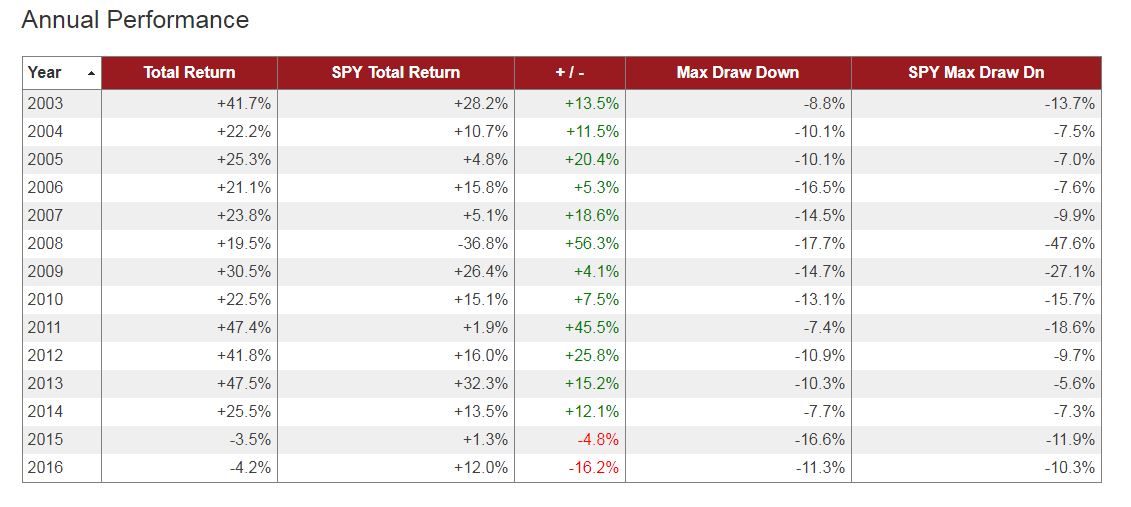

Utilizing the above ratios results in the following for the period 2003-2016 vs. the S&P 500 index:

For the past 6 years ECAM has been actively trading a proprietary strategy in their own brokerage accounts. The strategy is a combination of a 60% weighting in the ECAM Multi-Asset Trading Strategy and a 40% weighting in the Maximum Return Trading Strategy (for information on each of the strategies click the magenta links here and here to be taken to the descriptions page).

Utilizing the above ratios results in the following for the period 2003-2016 vs. the S&P 500 index:

As can be seen, performance was exceptional until 2015-2016 where volatility associated with Central Bank asset class manipulation led to back-to-back yearly losses. Clearly the strategy is robust but not infallible.

Invariably, when utilizing such an investment strategy was subsequently discussed with these individuals, the response was "how can I have my money managed in that way" as many individuals do not have time, experience or desire to commit 100% effort and time to this type of active strategy. Unfortunately, owing to the nature of current licensing and investment laws in the UAE, it was next to impossible to actively manage others accounts without considerable expense and red tape.

Recently a unique investment vehicle has been introduced through Interactive Brokers (one that allows a fixed number of individual accounts to be "linked" to a master account) that eliminates this barrier. For those who are unaware, Interactive Brokers is a U.S. based brokerage firm with offices in Chicago, Switzerland, Canada, Hong Kong, London and Sydney. They are a large and very well respected brokerage services with equity capital in excess of $5 billion. As of 2010 they had over 140,000 customer accounts worldwide with over $16.7 billion in client assets, execute over 1,000,000 trades per day, and trade 14.1% of the global equities options volume. For the past 7 years they have held the position as the lowest cost brokerage firm in the U.S. and, as such, are the preferred brokerage firm used extensively by hedge funds, professional traders and institutional investors

The unique structure Interactive Brokers offers allows individuals to open and fund their own personal brokerage accounts and have them "linked" to a master account managed by ECAM. While keeping each individual account separate, the "link" allows changes in asset allocation in the "master" account to produce the same changes in asset allocation in each of the "linked" accounts. Through this process, clients have the opportunity to have their individual brokerage accounts managed by ECAM.

The "linked" account structure IB offers has limited spaces available (due to restrictions imposed by Interactive Brokers) so only a limited number of clients are allowed access to this service.

If you believe you might be interested in this type of service please contact us for further details. Additional information is also available in the FAQ section on the website.

Invariably, when utilizing such an investment strategy was subsequently discussed with these individuals, the response was "how can I have my money managed in that way" as many individuals do not have time, experience or desire to commit 100% effort and time to this type of active strategy. Unfortunately, owing to the nature of current licensing and investment laws in the UAE, it was next to impossible to actively manage others accounts without considerable expense and red tape.

Recently a unique investment vehicle has been introduced through Interactive Brokers (one that allows a fixed number of individual accounts to be "linked" to a master account) that eliminates this barrier. For those who are unaware, Interactive Brokers is a U.S. based brokerage firm with offices in Chicago, Switzerland, Canada, Hong Kong, London and Sydney. They are a large and very well respected brokerage services with equity capital in excess of $5 billion. As of 2010 they had over 140,000 customer accounts worldwide with over $16.7 billion in client assets, execute over 1,000,000 trades per day, and trade 14.1% of the global equities options volume. For the past 7 years they have held the position as the lowest cost brokerage firm in the U.S. and, as such, are the preferred brokerage firm used extensively by hedge funds, professional traders and institutional investors

The unique structure Interactive Brokers offers allows individuals to open and fund their own personal brokerage accounts and have them "linked" to a master account managed by ECAM. While keeping each individual account separate, the "link" allows changes in asset allocation in the "master" account to produce the same changes in asset allocation in each of the "linked" accounts. Through this process, clients have the opportunity to have their individual brokerage accounts managed by ECAM.

The "linked" account structure IB offers has limited spaces available (due to restrictions imposed by Interactive Brokers) so only a limited number of clients are allowed access to this service.

If you believe you might be interested in this type of service please contact us for further details. Additional information is also available in the FAQ section on the website.