Sentry Page Protection

Please Wait...

Market/Model Commentary

Currently the active model portfolio as defined by our 5-factor model is:

ECAM 5-Factor Composite Model

"Slow and Steady wins the race"

The Hare and the Tortoise

Aesop (Greek slave & fable author 620 BC - 560 BC)

"Technical Analysis is a windsock, not a crystal ball"

Carl Swenlin (Technical Analyst)

"Investing is the intersection of economics and psychology"

Seth Klarman (Hedge fund Manager, Baupost Group)

"Everyone's got a plan ..... until they get punched in the face"

Mike Tyson (Former World Heavyweight Boxing Champion)

The Hare and the Tortoise

Aesop (Greek slave & fable author 620 BC - 560 BC)

"Technical Analysis is a windsock, not a crystal ball"

Carl Swenlin (Technical Analyst)

"Investing is the intersection of economics and psychology"

Seth Klarman (Hedge fund Manager, Baupost Group)

"Everyone's got a plan ..... until they get punched in the face"

Mike Tyson (Former World Heavyweight Boxing Champion)

Latest Updates

DOW JONES GLOBAL INDEX

(26 July 2024)

Global equities were lower this past week with a percentage return (as measured by the Dow Jones Global Index) of -0.78%. This week price closed above the 40 week moving average and above price support @ 591.

Technical Analysis Summary (Dow Jones Global Index)

Technical Analysis for W1DOW by TradingView

Click to set custom HTML

Dow Jones Global Index Historical Monthly Returns

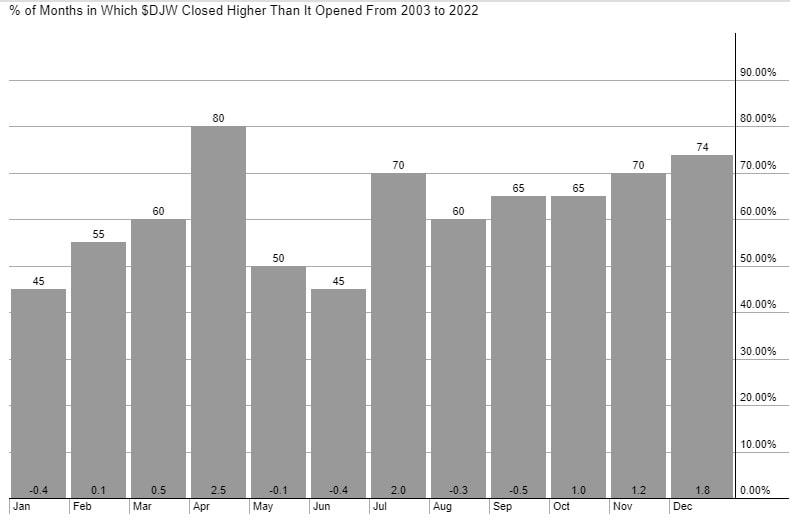

The month of June closed with a gain of +1.9%. We are now within July which has historically been a positive month within the seasonal cycle:

- +27.8% cumulative percentage return over the past 24 years.

- 62.5% win percentage.

- greatest gain +8.6% (2009)

- greatest loss -8.7% (2002)

Weekly Global Macro Review

U.S. Equities

The major US indexes ended mixed in a week that saw a continued rotation in market leadership to small-cap and value shares. The narrowly focused Dow Jones Industrial Average outperformed, and value stocks outpaced growth stocks by 4.77% basis points; the largest divergence since March 2023. The week was also notable for a widespread global disruption to computer systems early Friday due to an error in a vendor’s security update to some users of the Microsoft operating system.

The major US indexes ended mixed in a week that saw a continued rotation in market leadership to small-cap and value shares. The narrowly focused Dow Jones Industrial Average outperformed, and value stocks outpaced growth stocks by 4.77% basis points; the largest divergence since March 2023. The week was also notable for a widespread global disruption to computer systems early Friday due to an error in a vendor’s security update to some users of the Microsoft operating system.

|

S&P 500:

DJIA: NASDAQ 100: S&P 400 Mid-cap: Russell 2000 Small Cap: |

-2.0%

+0.7% -4.0% -0.2% +1.7% |

A major factor in the under-performance of growth stocks was a sharp decline in chip stocks on Wednesday, following news that the Biden administration had told allies it was considering severe export curbs if companies such as Tokyo Electron and the Netherlands’ ASML Holding continued providing China with access to advanced semiconductor technology. Chip giants Taiwan Semiconductor Manufacturing, Broadcom, and NVIDIA (the third-largest company by market capitalization) also fell sharply.

Polls showing an increasing likelihood of a Republican sweep in the November elections also appeared to favor value stocks. The prospect of lighter banking regulation seemed to provide a boost to the value-oriented financials sector, for example, while the prospect of higher tariffs under a Trump administration may have favored industrials and business services shares.

The week’s economic calendar generally surprised on the upside. Most notably, perhaps, retail sales, excluding the volatile gas and auto segments, jumped 0.8% in June, well above consensus and the most since January 2023. Building permits rose 3.4% in June, also more than expected, putting an end to three consecutive monthly declines. Similarly, the Federal Reserve reported on Wednesday that industrial production had increased 0.6% in June, roughly double estimates. On Thursday, the Philadelphia Fed reported that its gauge of current regional business conditions had jumped to its highest level in three years.

The Labor Department’s report of weekly jobless claims was the outlier, with the number of Americans filing for unemployment increasing to 243,000, rebounding to the nine-month high it established for the week ended June 8. More concerning may have been a 20,000 increase in continuing claims to 1,867,000, the highest number since November 2021.

US Bonds

Fed Chair Jerome Powell addressed the central bank’s dual mandate during a speech on Monday, saying, “Now that inflation has come down and the labor market has indeed cooled off, we’re going to be looking at both mandates. They’re in much better balance.” The yield on the benchmark 10-year U.S. Treasury note seemed to fall alongside inflation concerns over much of the week before spiking Friday in seeming reaction to worries over the Microsoft disruptions. (Bond prices and yields move in opposite directions.)

The level of issuance in the investment-grade corporate bond market surpassed expectations for the week, although the majority was oversubscribed. Most sectors closed with spreads unchanged to a touch tighter throughout the week. High yield bonds traded higher amid the stronger macro backdrop as rates rallied due to the market viewing the prospect of Fed rate cuts sooner than December as more likely. After a slow start, trade volumes increased as demand became stronger. However, issuance was subdued throughout the week.

Polls showing an increasing likelihood of a Republican sweep in the November elections also appeared to favor value stocks. The prospect of lighter banking regulation seemed to provide a boost to the value-oriented financials sector, for example, while the prospect of higher tariffs under a Trump administration may have favored industrials and business services shares.

The week’s economic calendar generally surprised on the upside. Most notably, perhaps, retail sales, excluding the volatile gas and auto segments, jumped 0.8% in June, well above consensus and the most since January 2023. Building permits rose 3.4% in June, also more than expected, putting an end to three consecutive monthly declines. Similarly, the Federal Reserve reported on Wednesday that industrial production had increased 0.6% in June, roughly double estimates. On Thursday, the Philadelphia Fed reported that its gauge of current regional business conditions had jumped to its highest level in three years.

The Labor Department’s report of weekly jobless claims was the outlier, with the number of Americans filing for unemployment increasing to 243,000, rebounding to the nine-month high it established for the week ended June 8. More concerning may have been a 20,000 increase in continuing claims to 1,867,000, the highest number since November 2021.

US Bonds

Fed Chair Jerome Powell addressed the central bank’s dual mandate during a speech on Monday, saying, “Now that inflation has come down and the labor market has indeed cooled off, we’re going to be looking at both mandates. They’re in much better balance.” The yield on the benchmark 10-year U.S. Treasury note seemed to fall alongside inflation concerns over much of the week before spiking Friday in seeming reaction to worries over the Microsoft disruptions. (Bond prices and yields move in opposite directions.)

The level of issuance in the investment-grade corporate bond market surpassed expectations for the week, although the majority was oversubscribed. Most sectors closed with spreads unchanged to a touch tighter throughout the week. High yield bonds traded higher amid the stronger macro backdrop as rates rallied due to the market viewing the prospect of Fed rate cuts sooner than December as more likely. After a slow start, trade volumes increased as demand became stronger. However, issuance was subdued throughout the week.

Europe/UK Equities

In local currency terms, the pan-European STOXX Europe 600 Index ended -2.7% lower amid rising trade tensions between the U.S. and China.

In local currency terms, the pan-European STOXX Europe 600 Index ended -2.7% lower amid rising trade tensions between the U.S. and China.

|

German DAX:

French CAC: Italian MIB: Spanish IBEX: U.K. FTSE 100: |

-3.1%

-2.5% -1.1% -1.4% -1.2% |

The European Central Bank (ECB) kept its key interest rates unchanged at 3.75%, as expected. It said it would not pre-commit to any rate path and emphasized that economic data would guide its decisions. ECB President Christine Lagarde said a move in September was “wide open,” adding that risks to economic growth were “tilted to the downside” and that inflation would fluctuate at current levels for the rest of the year before declining in the second half of 2025.

The ECB’s Bank Lending Survey for the three months through June showed household loan demand expanded for the first time in two years amid easier conditions on mortgages and optimism about the housing market. The banks taking part in the poll indicated that they expect this trend to continue in the third quarter.

Industrial production in the euro area in May fell 0.6% sequentially, declining for the first time since January, according to Eurostat. However, output dropped 2.9% year over year, with steep falls in Germany, Italy, and France.

Headline annual inflation in the UK held steady at 2% in June, partly due to a meaningful decline in energy costs compared with last year. Core inflation, excluding energy and food, remained at 3.5%. Services inflation, which is closely watched by policymakers, stayed at 5.7%.

Average earnings, excluding bonuses, grew by an annual 5.7% in the three months to May, down from 6.0% in April and the lowest level since mid-2022. However, the indicator remained close to double the rate, consistent with the Bank of England’s 2% inflation target.

The ECB’s Bank Lending Survey for the three months through June showed household loan demand expanded for the first time in two years amid easier conditions on mortgages and optimism about the housing market. The banks taking part in the poll indicated that they expect this trend to continue in the third quarter.

Industrial production in the euro area in May fell 0.6% sequentially, declining for the first time since January, according to Eurostat. However, output dropped 2.9% year over year, with steep falls in Germany, Italy, and France.

Headline annual inflation in the UK held steady at 2% in June, partly due to a meaningful decline in energy costs compared with last year. Core inflation, excluding energy and food, remained at 3.5%. Services inflation, which is closely watched by policymakers, stayed at 5.7%.

Average earnings, excluding bonuses, grew by an annual 5.7% in the three months to May, down from 6.0% in April and the lowest level since mid-2022. However, the indicator remained close to double the rate, consistent with the Bank of England’s 2% inflation target.

Japan

Japan’s stock markets lost ground over the week, with the Nikkei 225 Index falling -2.7% and the broader TOPIX Index down -1.2%. Technology stocks suffered on rising concerns about tighter U.S. restrictions on exporters of advanced semiconductor technology to China, including several Japanese chip makers.

The yen strengthened to around JPY 157.37 against the USD from the previous week’s 157.91. The Japanese currency’s second successive weekly gain came after recent suspected yen-buying operations by the government. Japan’s top currency official, Masato Kanda, suggested that there needs to be a response if speculators cause excessive foreign exchange moves. However, authorities typically refrain from immediately confirming whether a currency intervention has taken place, with data due to be released on the final day of July.

On the economic data front, the closely watched nationwide core consumer price index (CPI) rose 2.6% year on year (y/y) in June, up from 2.5% y/y in May but slightly short of consensus estimates of a 2.7% y/y increase. The overall inflation rate, which had been expected to rise, held steady at 2.8% y/y.

Japan’s economic fragility was highlighted by the government lowering its gross domestic product growth forecast for the current fiscal year ending March 2025 to a 0.9% expansion, from a gain of 1.3% projected in January. Much of the downgrade was attributable to sluggish domestic consumption amid rising import costs resulting from the weakness of the yen, which erodes households’ purchasing power. The government also presented its outlook for the fiscal year beginning April 2025, with the economy expected to achieve demand-led growth of 1.2%.

China

Chinese equities rose as investor sentiment was largely unaffected by weaker-than-expected economic growth in the second quarter. The Shanghai Composite Index was up +0.4% while the blue chip CSI 300 added +1.9%. In Hong Kong, the benchmark Hang Seng Index retreated -4.8%.

China’s gross domestic product expanded a below-consensus 4.7% in the second quarter from a year earlier, slowing from the 5.3% growth in the first quarter. On a quarterly basis, the economy grew 0.7%, less than half of the first quarter’s revised 1.5% expansion.

Other data also highlighted weakness in the economy. Retail sales grew a below-forecast 2% in June from a year earlier, down from a 3.7% increase in May, partly driven by lower autos and household appliances sales. Industrial production rose a better-than-expected 5.3% in June from a year earlier but slowed from May’s 5.6% increase. Fixed asset investment rose 3.9% in the January-to-June period from a year ago, in line with forecasts, though property investment fell 10.1% year on year. The urban unemployment rate remained steady at 5%, while the youth jobless rate dropped to 13.2%, the lowest level since December.

China’s new home prices fell 0.7% in June, matching May’s 0.7% drop and extending losses for the 12th consecutive month, according to the statistics bureau. The data suggested that a historic property rescue package unveiled by Beijing in May has done little to turn around the property market slump, which has emerged as a major growth headwind and left the economy dependent on exports for growth.

Japan’s stock markets lost ground over the week, with the Nikkei 225 Index falling -2.7% and the broader TOPIX Index down -1.2%. Technology stocks suffered on rising concerns about tighter U.S. restrictions on exporters of advanced semiconductor technology to China, including several Japanese chip makers.

The yen strengthened to around JPY 157.37 against the USD from the previous week’s 157.91. The Japanese currency’s second successive weekly gain came after recent suspected yen-buying operations by the government. Japan’s top currency official, Masato Kanda, suggested that there needs to be a response if speculators cause excessive foreign exchange moves. However, authorities typically refrain from immediately confirming whether a currency intervention has taken place, with data due to be released on the final day of July.

On the economic data front, the closely watched nationwide core consumer price index (CPI) rose 2.6% year on year (y/y) in June, up from 2.5% y/y in May but slightly short of consensus estimates of a 2.7% y/y increase. The overall inflation rate, which had been expected to rise, held steady at 2.8% y/y.

Japan’s economic fragility was highlighted by the government lowering its gross domestic product growth forecast for the current fiscal year ending March 2025 to a 0.9% expansion, from a gain of 1.3% projected in January. Much of the downgrade was attributable to sluggish domestic consumption amid rising import costs resulting from the weakness of the yen, which erodes households’ purchasing power. The government also presented its outlook for the fiscal year beginning April 2025, with the economy expected to achieve demand-led growth of 1.2%.

China

Chinese equities rose as investor sentiment was largely unaffected by weaker-than-expected economic growth in the second quarter. The Shanghai Composite Index was up +0.4% while the blue chip CSI 300 added +1.9%. In Hong Kong, the benchmark Hang Seng Index retreated -4.8%.

China’s gross domestic product expanded a below-consensus 4.7% in the second quarter from a year earlier, slowing from the 5.3% growth in the first quarter. On a quarterly basis, the economy grew 0.7%, less than half of the first quarter’s revised 1.5% expansion.

Other data also highlighted weakness in the economy. Retail sales grew a below-forecast 2% in June from a year earlier, down from a 3.7% increase in May, partly driven by lower autos and household appliances sales. Industrial production rose a better-than-expected 5.3% in June from a year earlier but slowed from May’s 5.6% increase. Fixed asset investment rose 3.9% in the January-to-June period from a year ago, in line with forecasts, though property investment fell 10.1% year on year. The urban unemployment rate remained steady at 5%, while the youth jobless rate dropped to 13.2%, the lowest level since December.

China’s new home prices fell 0.7% in June, matching May’s 0.7% drop and extending losses for the 12th consecutive month, according to the statistics bureau. The data suggested that a historic property rescue package unveiled by Beijing in May has done little to turn around the property market slump, which has emerged as a major growth headwind and left the economy dependent on exports for growth.

Weekly Performance

U.S. Indices

Dow +0.7% to 40,288. S&P 500 -2% to 5,505. Nasdaq -3.7% to 17,727. Russell 2000 +1.6% to 2,183. CBOE Volatility Index +32.6% to 16.52.

S&P 500 Sectors

Consumer Staples +0.9%. Utilities -1.6%. Financials +1.2%. Telecom -2.9%. Healthcare -0.3%. Industrials +0.6%. Information Technology -5.1%. Materials -0.5%. Energy +2%. Consumer Discretionary -2.7%. Real Estate +1.3%.

World Indices

London -1.2% to 8,156. France -2.5% to 7,535. Germany -3.1% to 18,172. Japan -2.7% to 40,092. China +0.4% to 2,982. Hong Kong -4.8% to 17,418. India +0.1% to 80,605.

Commodities and Bonds

Crude Oil WTI -3% to $78.6/bbl. Gold -0.7% to $2,402.8/oz. Natural Gas -8.8% to 2.124. Ten-Year Bond Yield -0.2 bps to 4.243.

Forex and Cryptos

EUR/USD -0.19%. USD/JPY -0.26%. GBP/USD -0.57%. Bitcoin +12.4%. Litecoin +4.8%. Ethereum +10.4%. XRP +11.2%.

Dow +0.7% to 40,288. S&P 500 -2% to 5,505. Nasdaq -3.7% to 17,727. Russell 2000 +1.6% to 2,183. CBOE Volatility Index +32.6% to 16.52.

S&P 500 Sectors

Consumer Staples +0.9%. Utilities -1.6%. Financials +1.2%. Telecom -2.9%. Healthcare -0.3%. Industrials +0.6%. Information Technology -5.1%. Materials -0.5%. Energy +2%. Consumer Discretionary -2.7%. Real Estate +1.3%.

World Indices

London -1.2% to 8,156. France -2.5% to 7,535. Germany -3.1% to 18,172. Japan -2.7% to 40,092. China +0.4% to 2,982. Hong Kong -4.8% to 17,418. India +0.1% to 80,605.

Commodities and Bonds

Crude Oil WTI -3% to $78.6/bbl. Gold -0.7% to $2,402.8/oz. Natural Gas -8.8% to 2.124. Ten-Year Bond Yield -0.2 bps to 4.243.

Forex and Cryptos

EUR/USD -0.19%. USD/JPY -0.26%. GBP/USD -0.57%. Bitcoin +12.4%. Litecoin +4.8%. Ethereum +10.4%. XRP +11.2%.

WEEKLY ASSET CLASS MONITOR

(week ending 26 July 2024)

(week ending 26 July 2024)

|

Asset Class

|

Region

|

ETF Ticker

|

Weekly

Return |

2024 Return

|

|

Equities

|

World

U.S. Europe Asia Pacific ex-Japan Emerging Market |

VT

VTI VGK AAXJ VWO |

-0.47%

-0.48% +0.62% -1.00% -0.46% |

+11.43%

+14.53% +7.85% +7.43% +6.91% |

|

Bonds

|

U.S. Bonds

International Bonds Global Bonds |

BND

BNDX BNDW |

+0.29%

+0.29% +0.28% |

+0.94%

+0.82% +0.85% |

|

Real Estate Equities

|

Global Real Estate Equities

|

REET

|

-0.12%

|

+1.93%

|

|

Precious Metals Equities

|

Global Gold Miners

Global Junior Gold Miners |

RING

GDXJ |

-2.37%

-3.18% |

+21.45%

+17.23% |

GLOBAL EQUITY MARKET MONITOR

The past 4 years have been very challenging for global equities. They had a wicked roller-coaster ride in 2020 on the back of the Covid pandemic where they peaked on 12 Feb 2020 and fell dramatically (-34%) into their 23 Mar lows. They then rebounded and regained their losses by year-end.

For most of 2021 they remained largely in a "holding pattern" digesting their gains but declined considerably throughout 2022 before bottoming in October. Strong returns have been seen since the Oct/22 bottom with global equities exceeding past all-time highs (previous highs for all regions shown as blue box)

For most of 2021 they remained largely in a "holding pattern" digesting their gains but declined considerably throughout 2022 before bottoming in October. Strong returns have been seen since the Oct/22 bottom with global equities exceeding past all-time highs (previous highs for all regions shown as blue box)

Asset Class Return Monitor

(for week ending 19 July 2024)

(for week ending 19 July 2024)

Equities Legend:

Bonds Legend:

Currencies Legend:

Commodities Legend:

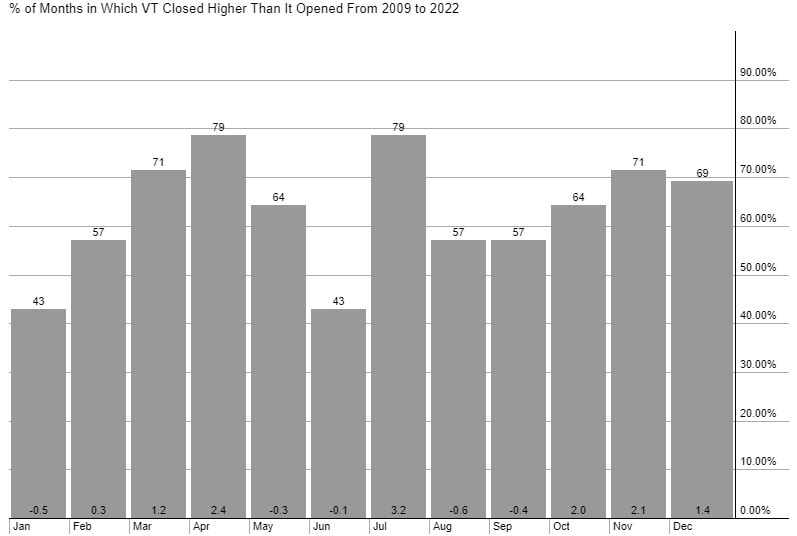

- Vanguard Total World Stock ETF (VT): (Cyan)

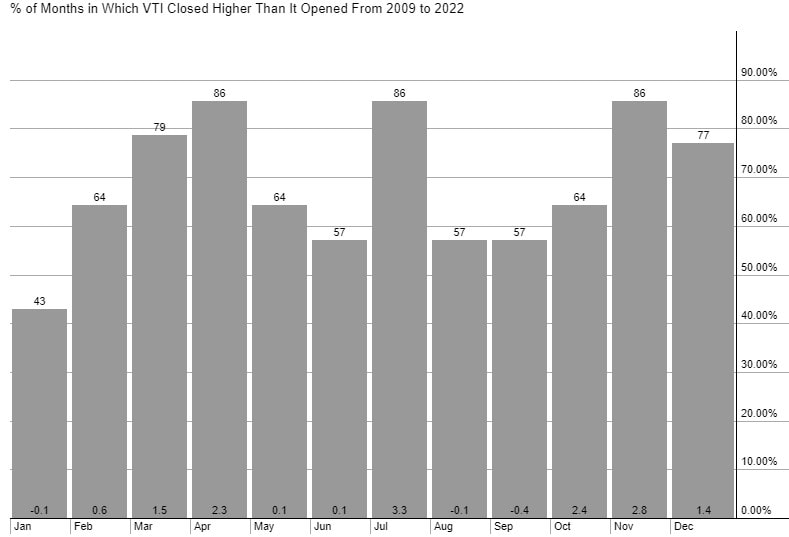

- Vanguard Total U.S. Stock Market ETF (VTI): (Red)

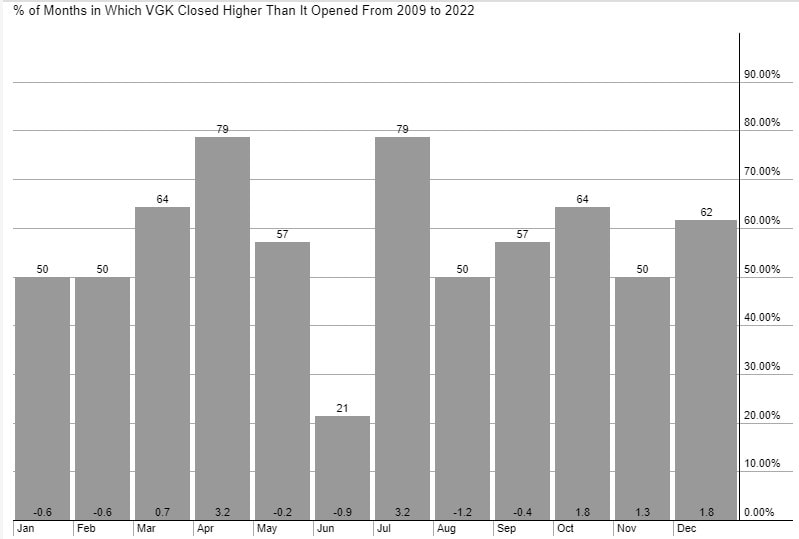

- Vanguard FTSE Europe ETF (VGK): (Lime Green)

- Ishares MSCI Asia ex-Japan ETF (AAXJ): (Dark Blue)

- Vanguard FTSE Emerging Markets ETF (VWO): (Pink)

Bonds Legend:

- Vanguard Total U.S. Bond Market ETF (BND): (Black)

- Vanguard Total International ex-U.S. Bond ETF (BNDX): (Green)

Currencies Legend:

- U.S. Dollar Index (Cash Settlement EOD) ($USD): (Orange)

- Euro (Philadelphia Index) ($XEU): (Maroon)

Commodities Legend:

- PowerShares DB Commodity Index Tracking Fund (DBC): (Purple)

- SPDR Gold ETF (GLD): (Sky Blue)

Past Week Asset Class returns

- Over the past week global equities (as measured by the Vanguard Total World Stock ETF (shown in CYAN) lost -2.03%.

- US markets were the top performing equity region this past week with Asia Pacific-ex Japan markets lagging.

- U.S. bonds (Black) and International bonds (Green) were mixed on the week.

- Commodities were lower on the week with the U.S. Dollar index up +0.32%.

Year-to-Date (2024) Asset Class returns

- In 2024 global equities (as measured by the Vanguard Total World Stock ETF shown in CYAN) have gained +11.87%.

- US market equities are the top performing equity region year-to-date with European markets lagging.

- Bonds have had flat returns in 2024 with U.S. bonds (Black) out-performing International Bonds (Green).

- The US Dollar index has gained +3.05% year-to-date.

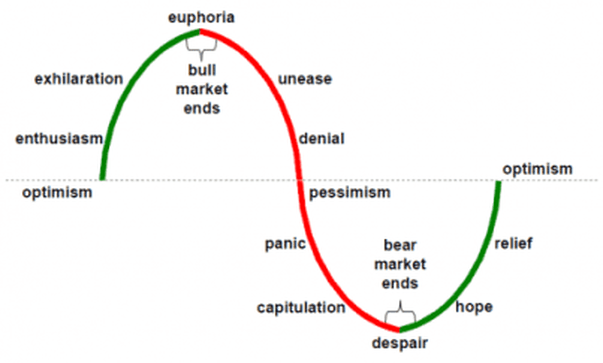

The stock market is driven by a combination of corporate profits, trends, economic data, fund flows, expectations, greed, fear, opinions, analysis, geopolitical events and human nature. These variables are often in conflict with one another (especially in the short run) and form a sine-wave cycle of investor psychology which begins with optimism, peaks with euphoria, bottoms with despair and returns to optimism.

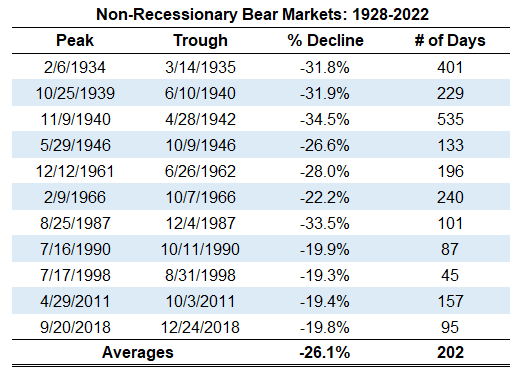

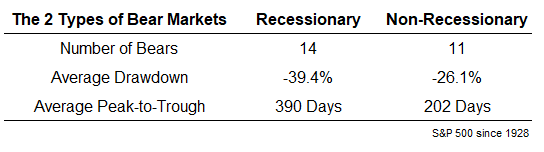

It must be reemphasized a complete market cycles is composed of 2 distinct cycles/phases: a "bull 1/2 cycle" and a "bear 1/2 cycle".

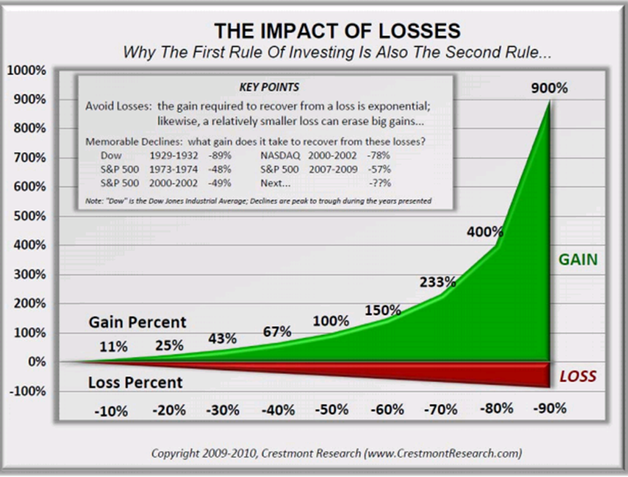

The Math of Losses

- a 20% loss requires a 25% gain to return to breakeven

- a 30% loss requires a 43% gain to return to breakeven

- a 40% loss requires a 67% gain to return to breakeven

- a 50% loss requires a 100% gain to return to breakeven

- a 60% loss requires a 150% gain to return to breakeven

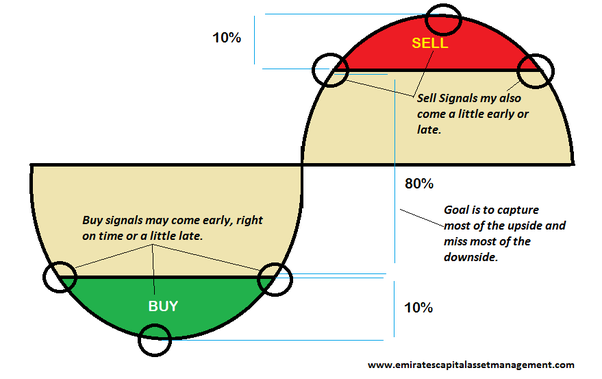

This is why it is so important to not let losses continue in the face of a bear market decline and why we advocate phased movements into cash as our 5-factor model reverts to Red. The below graphic represents how we move within equity markets through a complete sine-wave market cycle:

World Regional Equity Monitor

We use the following U.S. exchange traded funds to monitor equity performance for the various world regions:

- World Equities: Vanguard Total World ETF (Cyan)

- U.S. Equity: Vanguard Total Market ETF (Red)

- European Equity: Vanguard FTSE Europe ETF: (Lime Green)

- Japan Equity: iShares Japan ETF (Black)

- Asia ex-Japan Equity: iShares MSCI All-Country Asia ex-Japan ETF (Blue)

- Emerging Market Equity: Vanguard FTSE Emerging Market ETF (Pink)

1 Year Rolling Regional Equity Performance

- Over the past 12 month rolling period regional equity performance has been positive for monitored regions.

- The strongest equity regions over the past 12 month have been US markets with Japanese/European/Asia Pacific ex-Japan/Emerging market equities lagging.

- Overall world equity performance (as measured by the Vanguard Total World ETF) have returned +16.72% (including dividends) over the past 12 month rolling period.

3 Month Rolling Regional Equity Performance

- Over the past 3 month rolling period the strongest performing world equity region has been US markets with Japanese markets the weakest.

- Positive equity returns have been evident over the past quarter (3 months) in monitored regions.

1 Month Rolling Regional Equity Performance

- Over the past 1 month rolling period the strongest performing world equity region has been Japanese markets with Asia Pacific ex-Japan markets the weakest.

- Mixed equity returns have been achieved over the past month for most monitored regions.

Past Week Regional Equity Performance

- Over the past week the major global equities were lower with US markets outperforming other regions.

Latest Global Equity "Big Picture"

World equity market returns are monitored via the following index and ETF equity charts:

- Dow Jones Global Market Index (cap-weighted)

- Value Line Geometric U.S. Index (equal-weighted)

- Global Dow Index (equal-weighted)

- MSCI ACWI ETF (cap-weighted)

Dow Jones Global Market Index

(market cap weighted index)

For the week the Dow Jones Global Index had a loss of -0.78%. Price closed above the 52 week moving average (green line) and above support @ 575-579.

Value Line Geometric Index and Global Dow Index

(equal weighted indexes)

The Value Line Geometric Index ($XVG) is the median price performance of 1700 U.S. companies equal weighted (as opposed to most indexes which are market cap weighted) into an index. The Global Dow index ($GDOW) is a measure of the top 150 international companies equal weighted within the index.

These indexes are important as they equal-weight the price performance of all the companies held within the respective index. This removes the distortions associated with a small group of highly valued companies (which may be performing well) masking the performance of struggling companies and represents a good overview of overall internal equity breadth/strength.

These indexes are important as they equal-weight the price performance of all the companies held within the respective index. This removes the distortions associated with a small group of highly valued companies (which may be performing well) masking the performance of struggling companies and represents a good overview of overall internal equity breadth/strength.

Value Line Geometric Index ($XVG) Weekly

Global Dow Index ($GDOW) Weekly

iShares MSCI ACWI ETF

(market cap weighted ETF)

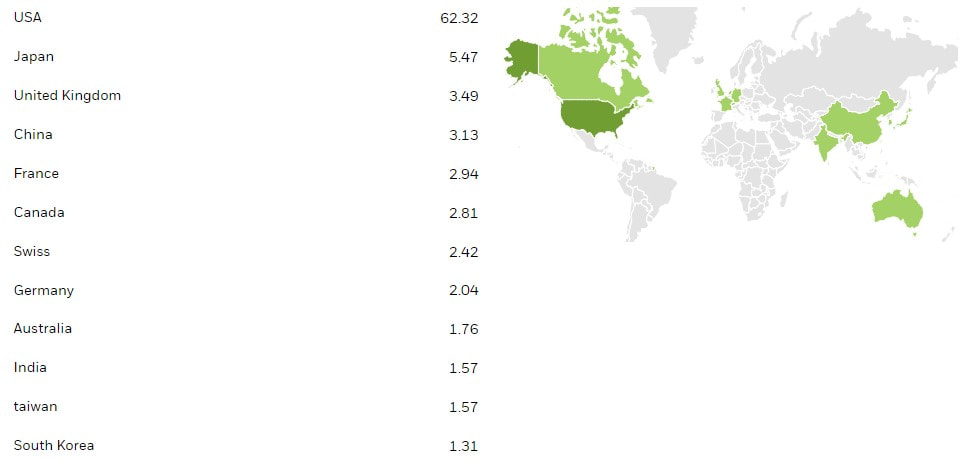

The iShares MSCI ACWI (All Country World Index) ETF is used as a benchmark to compare the performance of the various broad-based equity funds available in the Emirates Group Provident Scheme (EGPS) A/B/C accounts. It serves as a benchmark to determine how equity markets are performing on a worldwide basis. This assists in determining 2 parameters; whether to be invested in equities and also which funds within the EGPS offer the best performance relative to the benchmark.

The ETF is composed of the following regional components/weightings:

The ETF is composed of the following regional components/weightings:

ACWI Monthly Chart

Global equity markets bottomed in Oct 2022 and have reached new all-time highs.

For the month of July ACWI has gain +0.33%. It closed the month of June above the 12 month simple moving average (blue moving average on the chart above) keeping the long term trend BULLISH until month end.

For the month of July ACWI has gain +0.33%. It closed the month of June above the 12 month simple moving average (blue moving average on the chart above) keeping the long term trend BULLISH until month end.

ACWI Weekly Chart

This past week ACWI lost -0.63%. Price closed above the 40 week simple moving average (shown in GREEN) and this week closed above support @ 101.26-101.31.

World Equity Market Regional Relative Rotation Graphs

Below is a graph of 24 major regional equity market ETF's + ACWI (our world equity benchmark) shown on a Relative Rotation chart measured weekly with a 10 week look-back period (which forms the "tail" of the ETF). This graph allows us to observe over time how various regional ETF's are moving relative to both each other and also relative to cash.

- Leading (Green): (Momentum Positive + Price Relative Strength Positive)

- Weakening (Yellow): (Momentum Negative + Price Relative Strength Positive)

- Lagging (Red): (Momentum Negative + Price Relative Strength Negative)

- Improving (Blue): (Momentum Positive + Price Relative Strength Negative)

Given the cyclical nature of momentum and price within equity markets, in general the RRG charts will cycle in a clockwise manner (though not necessarily will each pass through all 4 quadrants as it is possible to rotate through an adjacent quadrant only).

Weekly Regional (Country) Relative Rotation Graphs (long term)

Your browser does not support viewing this document. Click here to download the document.

The RRG trend analysis status is currently BULLISH for world equities:

- ACWI Weekly Quadrant: "LEADING" Quadrant

- 24 Country Net Score: NEGATIVE

- ACWI price Relative Strength (horizontal axis): POSITIVE

- ACWI price Momentum (vertical axis): POSITIVE

Coincident Equity Market Indicators

Crude Oil

Crude oil was lower over the past week and remains rangebound. The 3-month correlation between crude oil and global equities is positive.

Gold

Gold was lower over the past week and closed above support @ 2028. The 3-month correlation between gold and global equities is positive.

Commodities

Commodities were lower over the past week and closed within their previous range. The 3-month correlation between commodities and global equities is neutral.

U.S. 30 Year Treasury Bond

U.S. 30 year bond prices were higher over the past week. The 3-month correlation between US government bonds and global equities is positive.

Current 5-Factor Model Indications

The combined 5-Factor quantitative model is currently YELLOW (neutral). This indicates an even level of risk at present. The 5-Factor model currently has the following sub-model readings:

Economic Model

The Economic model is currently GREEN. The 1-year rate-of-change in global economic data had moved towards contraction but has stabilized over the past several months. The model is composed of numerous inputs including data from the following sources:

Forward Forecast Data:

Forward Forecast Data:

- OECD Composite Leading Indicators (CLI)

- J.P. Morgan Global Purchasing Managers (PMI) Index

- World Bank Monthly Global Economic Report

OECD Composite Leading Indicators

(data as of 04 July 2024)

The OECD Composite Leading Indicator (CLI) is designed to predict business cycle changes 6-9 months in advance. It provides early signals of turning points in business cycles showing fluctuation of the economic activity around its long term potential level.

Click to set custom HTML

Below is our latest heat-map of the Composite Leading Indicators for various monitored regions.

Ideally we want to see the majority of regions indicating a CLI > 100 as well as steady/improving trends month-over-month and year-over-year.

- Red/Green numbers indicates above/below average future projected economic growth.

- Red/Green boxes indicates CLI change month/month and year/year.

Ideally we want to see the majority of regions indicating a CLI > 100 as well as steady/improving trends month-over-month and year-over-year.

Click to set custom HTML

Your browser does not support viewing this document. Click here to download the document.

J.P. Morgan Purchasing Managers Index (PMI)

(03 Jul 2024)

(03 Jul 2024)

The J.P. Morgan monthly PMI Report is based on the results of manufacturing and service sector surveys covering over 18,000 purchasing executives in over 40 countries. Together these countries account for an estimated 89% of global gross domestic product (GDP).

Questions are asked about real events and are not opinion based. Data are presented in the form of diffusion indices, where an index reading above 50.0 indicates an increase in the variable since the previous month and below 50.0 a decrease. As such, using the PMI data gives us a real-time look at global growth.

Questions are asked about real events and are not opinion based. Data are presented in the form of diffusion indices, where an index reading above 50.0 indicates an increase in the variable since the previous month and below 50.0 a decrease. As such, using the PMI data gives us a real-time look at global growth.

- readings > 50 indicate economic expansion

- readings < 50 indicate economic contraction.

Latest Key Findings:

- Global Composite Output Index declined to 52.9 (53.7 the previous month) and remains in expansion. It has now returned to its long term average Global PMI measure of 53.2.

- Global Manufacturing remained unchanged at 50.9 (50.9 the previous month) and remains in modest expansion.

- Global Services fell to to 53.1 (54.1 the previous month) and remains in steady expansion.

Your browser does not support viewing this document. Click here to download the document.

Global PMI Commentary

Your browser does not support viewing this document. Click here to download the document.

Below is our PMI monitor for selected regions/countries.

- numerical values > 50 (GREEN) indicate economic expansion in progress.

- numerical values < 50 (RED) indicating economic contraction in progress.

- trend box GREEN indicates improvement over the past month with RED indicating a decline over the previous month.

The latest data points to a strengthening of global growth from the late 2023 lows. The Global Composite Index remains in expansion (reading above 50)

Your browser does not support viewing this document. Click here to download the document.

World Bank Global Monthly Outlook

(June 2024)

(June 2024)

Your browser does not support viewing this document. Click here to download the document.

U.S. Economic Growth & Inflation

Year-over-Year GDP growth

The US economy expanded 2.9% year-on-year in the first quarter of 2024, slightly below 3.1% in the last three months of 2023. GDP Annual Growth Rate in the United States averaged 3.15 percent from 1948 until 2024, reaching an all time high of 13.40 percent in the fourth quarter of 1950 and a record low of -7.50 percent in the second quarter of 2020.

Quarter-over-Quarter GDP growth

The US economy expanded an annualized 2.8% in Q2, up from 1.4% in Q1, and above forecasts of 2%, the advance estimate showed. Consumer spending rose faster (2.3% vs 1.5%), led by a rebound in consumption of goods (2.5% vs -2.3%), mostly motor vehicles, recreational goods and vehicles, and gasoline while services slowed (2.2% vs 3.3%). Also, private inventories added 0.82 pp to the growth, after being a drag in the past 2 periods, led by wholesale trade and retail trade industries. Meanwhile, nonresidential investment accelerated (5.2% vs 4.4%), namely equipment (11.6% vs 1.6%) while intellectual property products (4.5% vs 7.7%) eased and investment in structures sank (-3.3% vs 3.4%). Also, government spending increased more (3.1% vs 1.8%) led by defense. On the other hand, residential investment contracted for the 1st time in a year (-1.4% vs 16%) and net trade dragged down on the growth for a 2nd consecutive quarter as imports rose faster (6.9% vs 6.1%) than exports (2% vs 1.6%).

Annualized Inflation

The annual inflation rate in the US fell for a third straight month to 3% in June 2024, the lowest since June 2023, compared to 3.3% in May and below forecasts of 3.1%. Energy costs rose at a slower pace (1% vs 3.7%), due to gasoline (-2.5% vs 2.2%) and fuel oil (0.8% vs 3.6%) while utility gas service (3.7% vs 0.2%) accelerated. Inflation also eased for shelter (5.2% vs 5.4%) and transportation (9.4% vs 10.5%) and steadied for apparel (0.8%). In addition, prices continued to decline for new vehicles (-0.9% vs -0.8%) and used cars and trucks (-10.1% vs -9.3%). On the other hand, food inflation edged up (2.2% vs 2.1%). Compared to May, the CPI unexpectedly declined 0.1%, the first fall since May 2020, following a flat reading and compared to expectations of a 0.1% rise. Meanwhile, annual core inflation also slowed to 3.3%, a fresh low since April 2021, from 3.4% in May and forecasts it would remain steady. The monthly rate edged down to 0.1% from 0.2%, below expectations of 0.2%.

Eurozone Economic Growth & Inflation

Year-over-Year GDP growth

The Eurozone's GDP expanded by 0.4% from the corresponding quarter of the previous year, well above market estimates of a 0.2% expansion, and gaining traction following two quarters of 0.1% growth. GDP Annual Growth Rate in Euro Area averaged 1.59 percent from 1995 until 2024, reaching an all time high of 14.90 percent in the second quarter of 2021 and a record low of -14.10 percent in the second quarter of 2020.

Quarter-over-Quarter GDP growth

The Eurozone’s economy expanded by 0.3% in the first quarter of 2024, the fastest growth rate since the third quarter of 2022, to beat market expectations of a marginal 0.1% expansion and gain traction following muted readings since the fourth quarter of 2022. The result added leeway for the European Central Bank to refrain from cutting rates to a larger extent this year should inflationary pressures prove to be more stubborn than previously expected. Among the currency bloc’s largest economies, both the German and the French GDPs expanded by 0.2%, while that from Italy grew by 0.3% and that from Spain expanded by 0.7%, all above market estimates. Compared to the same quarter of the previous year, the Eurozone’s GDP grew by 0.4%, beating market expectations of 0.2%, and gaining traction after two straight quarters of 0.1% growth.

Annualized Inflation

Inflation Rate In the Euro Area decreased to 2.50 percent in June from 2.60 percent in May of 2024. Inflation Rate in Euro Area averaged 2.23 percent from 1991 until 2024, reaching an all time high of 10.60 percent in October of 2022 and a record low of -0.60 percent in July of 2009.

Japan Economic Growth & Inflation

Year-over-Year GDP growth

The Gross Domestic Product (GDP) in Japan contracted 0.20 percent in the first quarter of 2024 over the same quarter of the previous year. GDP Annual Growth Rate in Japan averaged 1.74 percent from 1981 until 2024, reaching an all time high of 9.40 percent in the first quarter of 1988 and a record low of -9.70 percent in the second quarter of 2020.

Quarter-over-Quarter GDP growth

Japan's GDP shrank 0.5% qoq in Q1 of 2024, compared with market estimates of a 0.4% fall and after a downwardly revised stagnation in the prior quarter, a flash figure showed. Private consumption, which accounts for more than half of the economy, fell for the fourth straight quarter (-0.7% vs -0.4% in Q4), coming worse than forecasts of a 0.2% decrease and marking the steepest fall in three quarters as consumers continued to reduce their spending in the face of expensive costs of living and sluggish wages, and after a quake that struck the Noto peninsula at the start of the year. Capital expenditure also dropped (-0.8% vs 1.8%), compared with expectations of a 0.7% fall, due to the significant reduction of auto production after a scandal at Toyota's unit Daihatsu Motor. Net trade was also a drag on the GDP, matching forecasts, as exports (-5.0% vs 2.8%) declined more than imports (-3.4% vs 1.8%). On the other hand, government spending grew by 0.2%, compared with a 0.2% drop previously.

Annualized Inflation

The annual inflation rate in Japan accelerated to 2.8% in May 2024 from 2.5% in April, pointing to the highest reading since February. There was a steep upswing in electricity prices as energy subsidies fully ended (14.7% vs -1.1% in April), reversing declines in the prior 15 months. At the same time, prices rose further for food (4.1% vs 4.3%), housing (0.6% vs 0.6%), transport (2.3% vs 2.7%), furniture & household utensils (2.9% vs 2.5%), clothes (2.2% vs 2.2%), healthcare (1.1% vs 1.2%), culture (5.2% vs 6.2%), miscellaneous (1.2% vs 1.1%), and communication (0.4% vs 1.0%). By contrast, education prices fell for the second straight month (-1.0% vs -0.9%). The core inflation rate increased to 2.5% from April's 3-month low of 2.2%, compared with market forecasts of 2.6%. Monthly, the CPI rose by 0.5%, the most since last October.

China Economic Growth & Inflation

Year-over-Year GDP growth

The Chinese economy expanded 4.7% yoy in Q2 of 2024, missing market forecasts of 5.1% and slowing from a 5.3% growth in Q1. It was the weakest yearly advance since Q1 of 2023, amid a persistent property downturn, weak domestic demand, falling yuan, and trade frictions with the West. The latest figures came as the communist party began the Third Plenum, a key political event in which various reform measures are likely to be launched, along with recommendations for more support action to boost recovery. The economy grew by 5.0% during the first half of the year while the government is targeting the GDP to grow around 5.0% this year. In June alone, economic indicators mostly presented a slowdown, with retail sales rising the least in almost 1-1/2 years and industrial output growth at a 3-month low. Meantime, the urban jobless rate remained unchanged at 5.0% for the third month. On the trade front, exports increased more than expected last month but imports unexpectedly shrank.

Quarter-over-Quarter GDP growth

The Chinese economy grew by a seasonally adjusted 0.7% in Q2 of 2024, after a marginally revised 1.5% increase in Q1. While indicating the eighth straight period of quarterly rise, the latest result was the softest since Q2 of 2023, reflecting multiple headwinds at home such as extreme weather, weak consumption, high local government debts, and ongoing property weakness. At the same time, tensions with the US and its allies deepened. Premier Li Qiang recently signaled no shock therapy would come. “According to Chinese medical theory, we cannot use strong medicine at this time. We should precisely adjust and slowly nurture, allowing the economy to gradually recover." On the monetary front, the People's Bank of China has pledged to continue a supportive monetary policy stance. However, economists believed that the central bank was reluctant to trim lending rates further as rapid easing could mean more capital outflows from the country's struggling financial markets and pressure the yuan.

Annualized Inflation

China's annual inflation rate edged down to 0.2% in June 2024 from 0.3% in the prior two months, falling short of market estimates of 0.4%. It was the fifth straight month of consumer inflation but the lowest figure since March amid a fragile economic recovery. Food prices slipped for the 12th month (-2.1% vs -2.0%) despite a steep acceleration in pork prices during the Dragon Boat Festival. Meanwhile, non-food inflation was stable (at 0.8%), with prices rising further for clothing (1.5% vs 1.6% in May), housing (0.2% vs 0.2%), health (1.5% vs 1.5%), and education (1.7% vs 1.7%). At the same time, transport cost continued to fall (-0.3% vs -0.2%), as moves from some of China’s public utility companies to raise utility prices earlier in the year had a limited impact. The core consumer prices, deducting food and energy costs, increased 0.6% yoy, the same as in May. Monthly, the CPI declined by 0.2%, the third time of fall so far this year, compared with the consensus of a 0.1% fall.

Valuation Model

The Valuation model is currently YELLOW. Equity valuations are currently near the upper region of "fair value" relative to underlying current global economic fundamentals.

Technical Model

The Technical model is currently GREEN. Global equity markets have been in a trending advance since Oct 2023 following their Jul-Oct/23 correction.

Sentiment Model

The Sentiment model is currently RED. Overall sentiment has turned bullish (sentiment acts as an inverse shorter-term trading indicator).

Liquidity/Economic Stress Model

The Liquidity/Economic Stress model is currently GREEN. Steady and improving global economic growth continues to offset global central bank liquidity tightening.

World Bond Asset Class Return Monitor

We use the following U.S. exchange traded funds to monitor bond performance for the various bond asset classes:

Total Market Bond Basket:

- U.S. Total Bond Market (BND): (Red)

- International (ex-U.S.) Total Bond Market (BNDX): (Blue)

- U.S. Gov't Treasury Bonds (GOVT): (Orange)

- Foreign Developed Market Gov't Treasury Bonds (BWX): (Pink)

- U.S. Corporate Bonds (LQD): (Maroon)

- International Corporate Bonds (PICB): (Black)

- U.S. High Yield Bonds (JNK): (Purple)

- International High Yield Bonds (IHY): (Green)

- U.S. Gov't Inflation Protected Bonds (TIP): (Lime Green)

- International Gov't Inflation-Protected Bonds (WIP): (Cyan)

1 Year Rolling Bond Performance

- Over the past 12 months rolling period the top performing bond asset class has been US High Yield Bonds with Int'l Gov't Treasury Bonds the worst performing.

- The U.S. Total Bond Market (RED) and the International (ex-U.S.) Total Bond Market (BLUE) have delivered positive returns over the past year.

3 Month Rolling Bond Performance

- Over the past 3 month rolling period the top performing bond asset class has been US Corporate Bonds with Int'l Gov't Treasury Bonds lagging.

- U.S. Total Bond Market (RED) and International (ex-U.S.) Total Bond Market (BLUE) have delivered positive returns over the past quarter (3 months).

1 Month Rolling Bond Performance

- Over the past 1 month rolling period the top performing bond asset class has been Int'l Corporate Bonds with US Corporate Bonds lagging.

- The U.S. Total Bond Market (RED) and the International (ex-U.S.) Total Bond Market (BLUE) have delivered positive returns over the past month.

Past Week Bond Asset Class Performance

- Over the past week US High Yield Bonds were the top performing bond class.

- The U.S. Total Bond Market (RED) and the International (ex-U.S.) Total Bond Market (BLUE) posted mixed returns over the past week.

Commentary:

It has been shown in repeated studies over many years a balanced portfolio consisting of both equities and bonds (with percentage holdings in each adjusted according to personal risk tolerances) remains the best methodology in managing a long term retirement portfolio (due to the independent/low correlated function each takes when navigating though various market cycles and economic conditions).

It is best to think of bonds and equities as 2 independent brains each looking at the market from a different perspective:

As such, historically both serve a useful purpose in a balanced portfolio.

It is best to think of bonds and equities as 2 independent brains each looking at the market from a different perspective:

- Equities: Corporate profits focused.

- Bonds: Economic growth and Inflation focused.

As such, historically both serve a useful purpose in a balanced portfolio.

ETF Bond Proxies

Global aggregate bonds posted a gain of +0.28% over the past week. They have been rangebound in 2024 within a narrow trading range. They closed the week at the top end of the recent range and above the 52 week moving average.

The current bond bear market began 31 Dec 2020. Below is the performance of the 3 ETF's we use as "bond proxies" from that date to monitor global bond performance:

- BNDW: Vanguard Total World Bond market ETF (BLUE)

- BND: Vanguard Total U.S. Bond market ETF (GREEN)

- BNDX: Vanguard Total International (ex-U.S.) Bond market ETF (RED)

U.S. 10 year Treasury Yield

The most recent global bear market in bonds began in mid-2020 when the US Federal Reserve pushed interest rates to 0% to combat deflation. Below is charts for the various US Treasury yields from their peak (bond prices move inverse to yields so falling treasury yields are bullish for bond prices).

U.S. treasury yields rose in a parabolic manner into Oct, 2023 before their recent decline. This past week yields closed below support @ 4.213% and below the 52 week moving average.

German 10 year Bund Yield

German 10 year treasury yields bottomed in early 2020 during the depths of the European Covid shutdowns. They rebounded in a parabolic manner into Oct, 2023 before their recent decline. This past week yields closed below the 52 week moving average and below resistance @ 2.68%.

Japanese 10 year Treasury Yield

Japan has been fighting deflation for decades and only recent unprecedented monetary policy by the BOJ appears to be having some effect upon deflation (and yields).

After bottoming at near -0.28% in mid-2016, yields have risen and were able to finally break above 0.15% in early 2022. They are currently employing yield curve control (YCC) to keep rates pegged below 1.0% (increased from 0.5% in Jul/2023). This past week yields closed above support @ 0.579% and remain above the 52 week moving average.

After bottoming at near -0.28% in mid-2016, yields have risen and were able to finally break above 0.15% in early 2022. They are currently employing yield curve control (YCC) to keep rates pegged below 1.0% (increased from 0.5% in Jul/2023). This past week yields closed above support @ 0.579% and remain above the 52 week moving average.

Currencies

Below is the 12/3/1 month and weekly rolling returns for the 6 currencies that make up the U.S. Dollar index. The U.S. Dollar index is composed of a weighted geometric mean of the dollar's value relative to the 6 currencies in the following list:

In addition, we also include the following for comparison purposes:

- Euro (EUR), 57.6% weight.

- Japanese yen (JPY) 13.6% weight.

- U.K. Pound sterling (GBP), 11.9% weight.

- Canadian dollar (CAD), 9.1% weight.

- Swedish krona (SEK), 4.2% weight.

- Swiss franc (CHF) 3.6% weight.

In addition, we also include the following for comparison purposes:

- The Australian Dollar (not a part of the USD Index) as it is a popular commodity currency.

- Gold (priced in USD) as it typically acts more like a currency void of fiat printing.

1 Year Rolling Currency Performance

- Over the past 12 months rolling period the top performing major currency has been Gold with the Japanese Yen the worst performing.

3 Month Rolling Currency Performance

- Over the past 3 month rolling period the top performing currency has been the British Pound with the Japanese Yen lagging.

1 Month Rolling Currency Performance

- Over the past 1 month rolling period the top performing currency has been Gold with the Swedish Krona lagging.

Past Week Currency Performance

- Over the past week the top performing major currency was the Swiss Franc with the Australian Dollar lagging.

U.S. Dollar: (Neutral Bias)

Commentary:

The USD was up +0.19% over the past week. It had been confined to a 7-month consolidation range before breaking lower in July but has returned back to the previous range.

Support / Resistance Levels (based upon respective time period closing price):

Weekly: 102.95 / 106.43

Monthly: 101.03 / 106.43

Support / Resistance Levels (based upon respective time period closing price):

Weekly: 102.95 / 106.43

Monthly: 101.03 / 106.43

US Dollar Index Daily charts

The 2 year daily chart (above) shows the trading range the USD has been confined to since late 2022.

The 10 year daily chart (above) shows the strong price zone between 103.29-103.61. Support is now 100.04-100.21.

Over the past week the USD closed between its short term trend 50 and 200 day moving averages.

(Short Term Neutral)

(Short Term Neutral)

US Dollar Index Weekly charts

The weekly chart shows the recent trading range since late 2023. Price is currently challenging the midpoint of the range.

Price closed the week between the intermediate term trend 20 and 65 week moving averages.

(Intermediate Term Neutral)

Price closed the week between the intermediate term trend 20 and 65 week moving averages.

(Intermediate Term Neutral)

A longer term 20 year look-back at the USD shows the 79.05-104.32 price (yellow) area has been a very significant bull/bear battle zone since 1986.

US Dollar Index Monthly chart

For the month of July the U.S. Dollar index has lost -1.16%. Price remains confined to the rising price channel from the 2011 lows and remains confined to a 16 month consolidation zone between 101.03-106.49.

Price closed June above the long term trend 10 month moving average keeping the long term bias to Bullish until months end.

(Long Term Bullish)

Price closed June above the long term trend 10 month moving average keeping the long term bias to Bullish until months end.

(Long Term Bullish)

Euro (Bullish Bias)

The Euro was down -0.23% over the past week. It has remained largely range bound between 105-112 over the past year.

Support / Resistance Levels (based upon respective time period closing price):

Weekly: 107.50 / 111.75

Monthly: 105.25 / 114.27

Support / Resistance Levels (based upon respective time period closing price):

Weekly: 107.50 / 111.75

Monthly: 105.25 / 114.27

Euro Daily Charts

The Euro topped out in early 2018 @ 125.10 and had been on a steady decline until March 2020. It rose dramatically into the end of 2020 had remained range bound in 2021 until its recent breakdown.

On the 2nd daily chart price it can be seen how important the yellow band daily resistance zone @ 114.61-116.04 is going back to 2015. Other areas of daily support/resistance are seen at 108.24-108.66 and 103.90-105.69.

The Euro closed the week above the short term trend 50 and 200 day moving averages.

(Short Term Bullish)

On the 2nd daily chart price it can be seen how important the yellow band daily resistance zone @ 114.61-116.04 is going back to 2015. Other areas of daily support/resistance are seen at 108.24-108.66 and 103.90-105.69.

The Euro closed the week above the short term trend 50 and 200 day moving averages.

(Short Term Bullish)

Euro Weekly Chart

The Euro peaked in 2008 and achieved a bottom in 2022. It has been on a steady decline but recently broke above important resistance @ 104.51-104.96 (which now should act as support).

This past week the Euro closed the week above the intermediate trend 20 week + 65 week moving averages.

(Intermediate Term Bullish)

This past week the Euro closed the week above the intermediate trend 20 week + 65 week moving averages.

(Intermediate Term Bullish)

Euro Monthly

For the month of July the Euro has gained +1.36%. On a monthly closing basis it closed the month of June below the long term trend 10 month moving average switching the long term outlook bearish until months end.

(Long Term Bearish)

(Long Term Bearish)

UK Pound (Bullish Bias)

U.K. Pound Daily Charts

U.K. Pound Weekly Charts

U.K. Pound Monthly Charts

The British Pound was down -0.29% over the past week. It continues to recover from lows last seen 37 years ago. Historically since 1987 the Pound has traded within a range of 1.40 to 2.00 with brief excursions above/below this range. The previous all-time low over the past 200 years was 1.0520 (daily low @ 1.0438) seen in the 1st quarter of 1985 which was revisited in September 2022 (close 1.0696 27 Sep 2022).

This past week the Pound closed the week above its short term trend daily 50 +200 day moving averages and above the intermediate term trend 20 + 65 week moving averages. For the month of July it has gained +1.77% and closed the month of June above its long term 10 month moving average (which technically keeps the long term bullish until months end).

(Short Term Bullish)

(Intermediate Term Bullish)

(Long Term Bullish)

Support / Resistance Levels (based upon respective time period closing price):

Weekly: 121.54 / 131.43

Monthly: 121.33 / 133.09

This past week the Pound closed the week above its short term trend daily 50 +200 day moving averages and above the intermediate term trend 20 + 65 week moving averages. For the month of July it has gained +1.77% and closed the month of June above its long term 10 month moving average (which technically keeps the long term bullish until months end).

(Short Term Bullish)

(Intermediate Term Bullish)

(Long Term Bullish)

Support / Resistance Levels (based upon respective time period closing price):

Weekly: 121.54 / 131.43

Monthly: 121.33 / 133.09

Australian Dollar (Neutral Bias)

Australian Dollar Daily Chart

Australian Dollar Weekly Charts

Australian Dollar Monthly Chart

The Australian Dollar lost -1.98% over the past week. It topped in Apr/2021 and has been on a steady downtrend to present.

For the month of July the Aussie dollar has lost -1.79%. It closed the week below the short term trend 50 + 200 day moving averages and below the intermediate term trend 20 + 65 week moving averages. It closed the month of June above the long term trend 10 month moving average keeping the long term outlook bullish until months end.

(Short Term Bearish)

(Intermediate Term Bearish)

(Long Term Bullish)

Support / Resistance Levels (based upon respective time period closing price):

Weekly: 61.99 / 69.11

Monthly: 63.58 / 70.17

For the month of July the Aussie dollar has lost -1.79%. It closed the week below the short term trend 50 + 200 day moving averages and below the intermediate term trend 20 + 65 week moving averages. It closed the month of June above the long term trend 10 month moving average keeping the long term outlook bullish until months end.

(Short Term Bearish)

(Intermediate Term Bearish)

(Long Term Bullish)

Support / Resistance Levels (based upon respective time period closing price):

Weekly: 61.99 / 69.11

Monthly: 63.58 / 70.17

Canadian Dollar (Neutral Bias)

Canadian Dollar Daily Chart

Canadian Dollar Weekly Chart

Canadian Dollar Monthly Chart

The Canadian dollar lost -0.71% over the past week and continues to recover off its Covid-lows of late March 2020 (it is largely tied to the price of commodities so the anticipated global recovery has benefited CAD).

The Loonie closed the week below the short term trend 50 + 200 day moving averages and below the intermediate term trend 20 + 65 week moving averages. For the month of July the Loonie has lost -1.11%. It closed the month of June below the long term trend 10 month moving average keeping the long term bearish until months end.

(Short Term Bearish)

(Intermediate Term Bearish)

(Long Term Bearish)

Support / Resistance Levels (based upon respective time period closing price)

Weekly: 72.96 / 75.91

Monthly: 72.17 / 75.95

The Loonie closed the week below the short term trend 50 + 200 day moving averages and below the intermediate term trend 20 + 65 week moving averages. For the month of July the Loonie has lost -1.11%. It closed the month of June below the long term trend 10 month moving average keeping the long term bearish until months end.

(Short Term Bearish)

(Intermediate Term Bearish)

(Long Term Bearish)

Support / Resistance Levels (based upon respective time period closing price)

Weekly: 72.96 / 75.91

Monthly: 72.17 / 75.95

Key Weekly Returns (week ending 26 July 2024):

|

Countries/Regions

World Equities ACWI (iShares MSCI ACWI Index Fund) North American Equities SPY (S&P 500 SPDRs) QQQ (PowerShares QQQ Trust) IWM (Russell 2000 iShares) EWC (Canada iShares) |

Characteristics

Global Equity Fund U.S. Large Cap S&P 500 Index U.S. NASDAQ 100 Fund U.S. Russell 2000 Small Cap Fund Canada |

Week % Change

-0.63% -0.83% -2.58% +3.40% -0.08% |

Non-North America Equities

|

VGK (Vanguard European VIPERs) EPP (iShares MSCI Pacific ex-Japan ) EWJ (Japan iShares) EEM (iShares MSCI Emerging Markets) ILF (Latin America 40 Index iShares) Bonds

BND (Vanguard Total U.S. Bond Market) BNDX (Vanguard International Bond ETF) TIP (iShares Barclays TIPS Bond Fund) PCY (PowerShares Emerging Markets Debt Portfolio) |

Europe/U.K Pacific ex-Japan (inc. Australia + NZ) Japan Emerging Markets Latin America US Total Bond (44% Gov't Tsy, 56%Corp) World Investment Grade Bonds ex-US Inflation Protected Gov't Bonds Emerging Market Sovereign Debt |

+0.62% -1.11% -1.86% -0.84% -2.45% +0.30% +0.31% +0.06% +0.27% |

|

Commodities

DBC (DB Commodities Tracking Index Fund) DBA (PowerShares DB Agriculture Fund) GLD (SPDR Gold Trust Shares) SLV (iShares Silver Trust) DBB (PowerShares Metals Fund) USO (United States Oil Fund) |

Commodity Basket Soft Commodity Basket Gold Bullion Silver Bullion Industrial Metals Light Crude Oil |

-1.51% +1.11% -0.50% -4.53% -3.15% -2.42% |

Currencies

|

UUP (PowerShares DB US Dollar Bullish Fund)

FXA (Currency Shares Australian Dollar Trust) FXB (Currency Shares British Pound Sterling Trust) FXC (Currency Shares Canadian Dollar Trust) FXE (Currency Shares Euro Trust) FXY (Currency Shares Japanese Yen Trust) |

U.S. Dollar

Australian Dollar U.K. Sterling Canadian Dollar Euro Japanese Yen |

+0.03%

-1.95% -0.23% -0.63% -0.18% +2.42% |

Important Charts to Watch

Commodity Basket Index

Commodities (as measured by the Reuters/Jefferies CRB index, a basket of 19 commodities) bottomed in April, 2020 and peaked in June, 2022. They were highly impacted by the Covid pandemic actions and have been attempting to stabilize near 8 year highs.

Resistance remains @ 298.17 with support @ 254.66. Commodity prices strong influence inflation so the recent consolidation near its peak is indicative of lingering global inflationary pressures post-Covid.

Resistance remains @ 298.17 with support @ 254.66. Commodity prices strong influence inflation so the recent consolidation near its peak is indicative of lingering global inflationary pressures post-Covid.

Equity Market Volatility

The Volatility Index (VIX) is a measure of expected price fluctuations of options on the S&P 500 index options over the next 30 days (technically the VIX is quoted in percentage points and represents the expected range of movement in the S&P 500 index over the next year, at a 68% confidence level i.e. one standard deviation of the normal probability curve). For example, if the VIX is 15, this represents an expected annualized change, with a 68% probability, of less than 15% up or down.

In general it can be said there are four VIX volatility regimes:

The VXV uses the same calculation as the VIX but looks forward 3 months. When the VIX is greater than the VXV ($VIX:$VXV ratio > 1.0) the volatility structure is termed to be in "contango". It indicates traders are much more concerned about short term volatility than they are about longer term volatility and when that ratio returns to "normal" (< 0.93) it is typically a good sign market stress is easing (and a good time to add to equity positions).

As of this weeks market close volatility closed below the "VIX Event End Line" area with the VIX below 20. The volatility structure is currently BULLISH for equities.

In general it can be said there are four VIX volatility regimes:

- < 20 is trending bullish for equities

- ≈ 20-25 is choppy bullish for equities

- ≈ 25-30 is choppy bearish for equities

- > 30 is trending bearish for equities

The VXV uses the same calculation as the VIX but looks forward 3 months. When the VIX is greater than the VXV ($VIX:$VXV ratio > 1.0) the volatility structure is termed to be in "contango". It indicates traders are much more concerned about short term volatility than they are about longer term volatility and when that ratio returns to "normal" (< 0.93) it is typically a good sign market stress is easing (and a good time to add to equity positions).

As of this weeks market close volatility closed below the "VIX Event End Line" area with the VIX below 20. The volatility structure is currently BULLISH for equities.

Global Banks

Up until recently US banks were thought to be quite stable. However, several recent failures have now brought US banks into focus. Below is a chart of the KBE (US Bank ETF) and KRE (US Regional Bank ETF). We are watching closely for further signs of stress following the recent declines.

Since the 2009 market bottom Europe has been the weakest major equity growth region. As such, we continue to monitor European financial stocks (represented below using the iShares MSCI European Financials ETF).

European financials bottomed in March, 2022 and have been very strong.

European financials bottomed in March, 2022 and have been very strong.

Chinese Equities

The Shanghai Composite index was lower over the past week and remains above important support @ 2730-2745. It has remained rangebound since 2015.

Chinese growth remains key to both Emerging market performance as well as an indication of Developed markets demand. From its peak in mid-2015, the Shanghai index lost more than -50% to its recent lows. We would like to see significant strength return to China further indicating world economic growth has positively turned the corner.

Chinese growth remains key to both Emerging market performance as well as an indication of Developed markets demand. From its peak in mid-2015, the Shanghai index lost more than -50% to its recent lows. We would like to see significant strength return to China further indicating world economic growth has positively turned the corner.

PRECIOUS METALS

Precious metals (and their respective producers) are an area we recommend all investors consider having a small position within. Precious metals perform well during times when real (inflation adjusted) interest rates are falling and/or when the USD is weak. The following charts can be utilized to determine when the risk/reward is favorable.

Below is a ratio price chart of gold stocks (HUI; the "Gold Bugs" Index) to gold bullion going back to 1996 when the Gold Bugs Index first came into existence. As can be seen, whenever the HUI:GOLD ratio dips to below approximately 0.14 (the GREEN zone on the chart) has been a low-risk opportunity to acquire gold stocks.

Gold stocks remain in the "low-risk vs. high-reward" range and until recently remain near their cheapest valuations in 8 years. Historically purchases of gold equities when within the green-zone have been a very good long term buy-and-hold opportunities.

Gold stocks remain in the "low-risk vs. high-reward" range and until recently remain near their cheapest valuations in 8 years. Historically purchases of gold equities when within the green-zone have been a very good long term buy-and-hold opportunities.

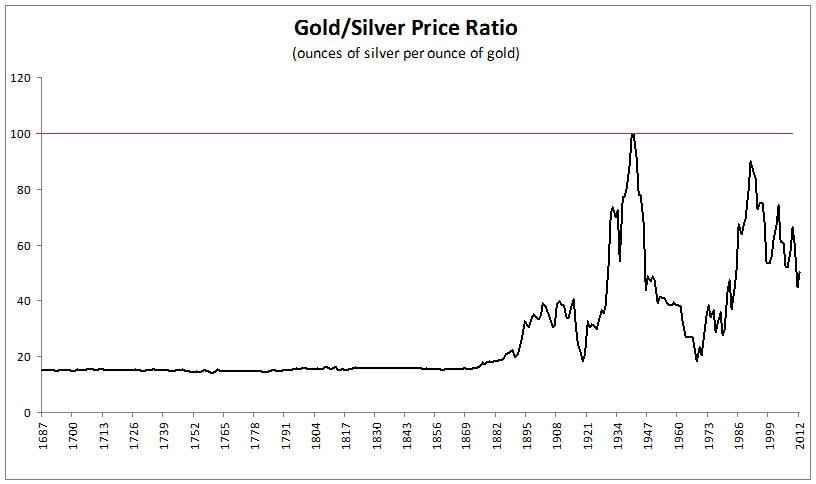

Equally bullish is Silver (chart below) which remains at a price ratio relative to the price of gold (GREEN zone on the chart) which has historically been a low risk entry point over the past 40 years.

Silver remains cheap relative to gold.

To put the valuation into a longer term perspective, below is a chart of the Gold/Silver ratio (the opposite ratio to Silver/Gold) going back to 1687. Clearly it can be seen a gold:silver ratio > 80 has historically been an outlier over the past 100+ years (and greater than 100 is historic):

The current Gold:Silver ratio recently exceeded 120 for the 1st time in history and remains near the top end of 40 year highs. It can be seen each instance in the past 40 years where the ratio has crossed above 80 has resulted in very good long term gains in silver.

The move in Silver we have been anticipating appears to have begun but there remains plenty of room to allow the ratio to fall to the "sell" level near 45.

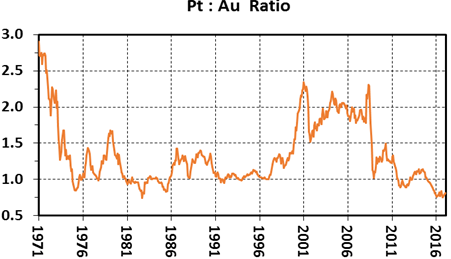

EVEN MORE BULLISH is the price of Platinum (chart below) which has exceeded the "buy zone" last seen in 1982! Platinum is 15-20 times rarer than gold and has rarely in history traded at a price below the price of gold (only 9.7% of the time going back to 1971). It is now the cheapest it has been GOING BACK TO AUGUST 1971 WHEN THE U.S. LEFT THE GOLD STANDARD on a relative basis:

- The current Platinum:Gold ratio remains below 0.85 (red line on the chart below).

- A Platinum/Gold ratio < 0.85 has only occurred 4.7% of the time back to 1971.

- Prior to recent lows, the lowest Platinum:Gold ratio since August 1971 (when the USD was removed from the gold standard) was hit on 20 Sept 1982 when it hit a ratio low of 0.689 (Platinum $300.40/Gold $436.00).

- If Platinum were to return to its most common ratio relative to Gold (1.0x-1.25x which has been common 35% of the time) it would imply a price rise of approximately 50-90% from recent levels.

Platinum now sits on a price support extending back to 2004 and, combined with its ratio relative to the price of gold, represents a compelling long term buy point.

The following charts and commentary (in italics; bold print is our emphasis) are sourced from Kitco from commentary sourced in Feb 2017 when the ratio was near 0.85 (Platinum has become even cheaper on a relative basis since the data was published):

Platinum to gold ratios show wide variance over the 46 year period ranging from highs above 2.5 before and soon after Nixon began taking the United States off the gold standard to periodic lows below 1.0:

Platinum to gold ratios show wide variance over the 46 year period ranging from highs above 2.5 before and soon after Nixon began taking the United States off the gold standard to periodic lows below 1.0:

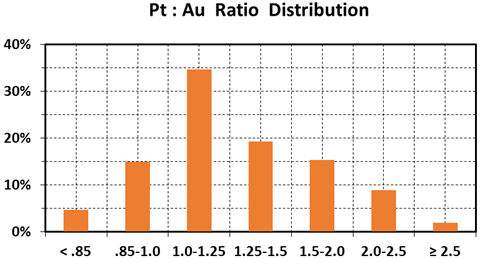

Our data set covers 553 months beginning in January 1971. The distribution of ratios in both tabular and chart format follows:

Platinum/Gold Ratio: % of Months

Platinum/Gold Ratio: % of Months

- < 0.85: 4.7%

- .85-1.01: 5.0%

- 1.0-1.25: 34.7%

- 1.25-1.5: 19.3%

- 1.5-2.0: 15.4%

- 2.0-2.5: 8.9%

- > 2.5: 2.0%

From our data set and the distributions of monthly average platinum-gold ratios from January 1971 thru January 2017, I glean the following:

From a compendium of sources, the average crustal abundance of both metals is around 4 ppb. Based solely on this fact, platinum and gold should trade at about the same price.

And indeed, our compilation shows that for nearly 50% of the time since gold was decoupled from the world’s reserve currency and allowed to trade freely on exchanges, the price ratio has ranged from 0.85 to 1.25. That said, since January 1971, the average price of platinum has been $637/oz and gold has been $518/oz for an overall ratio of 1.23:1. Clearly there are other factors other than the nearly equal crustal abundances that account for this historic price relationship.

A variety of supply and demand factors cause platinum to trade at a premium to gold:

Fluctuations in the relative prices of platinum and gold are largely driven by:

Platinum functions both as a precious and industrial metal. It is usually tied to the price of gold in both short- and long-term trading patterns. In times of financial distress and economic turmoil, platinum tends to behave more like gold with widespread hoarding.

The platinum-gold ratio can be used to ascertain whether one metal is over- or undervalued with respect to the other. The current monthly average ratio below 0.85 is unusual and indicates that platinum is severely undervalued with respect to gold *

* The ratio recently hit 0.55 and remains near a record low.

- A ratio of less than 0.75 is a single outlier that occurred once during the second half of 1982 when overall ratios averaged 0.81.

- Ratios <0.85 are quite unusual at 4.7%. They occurred for two months in the first quarter of 1975, the aforementioned six months in 1982, in June-July of 1985, and for an ongoing run of 16 months that commenced in October 2015.

- Ratios from 0.85 to 1.0 constitute 15.0% of the record.

- Pt:Au from 1.0 to 1.25 is the most common range and comprises 34.7% of ratios since 1971.

- The ratios between 1.25 and 1.5 occur 19.3% of the time.

- Ratios from 1.5 to 2.0 make up 15.4% of the record.

- The 2.0-2.5 interval covers 8.9% of the months in our compendium.

- The 11 monthly outliers at >2.5 comprise 2.0% of the total record and have not occurred since 1971.

From a compendium of sources, the average crustal abundance of both metals is around 4 ppb. Based solely on this fact, platinum and gold should trade at about the same price.

And indeed, our compilation shows that for nearly 50% of the time since gold was decoupled from the world’s reserve currency and allowed to trade freely on exchanges, the price ratio has ranged from 0.85 to 1.25. That said, since January 1971, the average price of platinum has been $637/oz and gold has been $518/oz for an overall ratio of 1.23:1. Clearly there are other factors other than the nearly equal crustal abundances that account for this historic price relationship.

A variety of supply and demand factors cause platinum to trade at a premium to gold:

- Platinum is a much smaller market. Cumulative world production of platinum is estimated to be about 5% of gold (9400 tonnes versus 182,000 tonnes). From 1994-2014, 3700 tonnes of platinum were mined versus 52,600 tonnes of gold or about 7% (source: USGS).

- Platinum is largely an industrial metal. Catalytic converters, electronics, petroleum and chemical catalysts, medical technologies, and many minor uses constitute over 60% of its annual demand. Around 30% is used in jewelry and 10% for investment demand. Also, 30% of the annual platinum supply now comes from recycling, mostly from catalytic converters. Some demand is consumed and lost to the marketplace.

- Gold is overwhelmingly a precious metal; 90% is used in jewelry and investments and only 10% in industrial applications. An estimated 98% of all the gold ever mined in the world remains available and held in jewelry, by central banks, in private hoards, and as fabricated products (source: USGS).

- About 70% of yearly platinum mine supply comes from South Africa, a geopolitically risky country. Much new platinum is a by-product of nickel-copper mining and smelting; therefore, annual platinum production is dependent on the supply-demand fundamentals and prices of these primary metals.

Fluctuations in the relative prices of platinum and gold are largely driven by:

- the overall growth and health of the world’s economy and in the case of platinum, the automotive industry;

- labor, power, currency, and political issues in South Africa that cause major perturbations in the platinum supply;

- safe haven hoarding of gold and to a much lesser extent, platinum, in times of economic uncertainty and major geopolitical events; speculators moving in and out of paper markets of both metals (bullion exchanges, ETFs, and derivatives) and to a lesser extent, central bank trading of physical gold.

Platinum functions both as a precious and industrial metal. It is usually tied to the price of gold in both short- and long-term trading patterns. In times of financial distress and economic turmoil, platinum tends to behave more like gold with widespread hoarding.

The platinum-gold ratio can be used to ascertain whether one metal is over- or undervalued with respect to the other. The current monthly average ratio below 0.85 is unusual and indicates that platinum is severely undervalued with respect to gold *

* The ratio recently hit 0.55 and remains near a record low.

U.S. Equity Market Valuation

Crestmont Price/Earnings Ratio

(Source: Crestmont Research)

(Source: Crestmont Research)

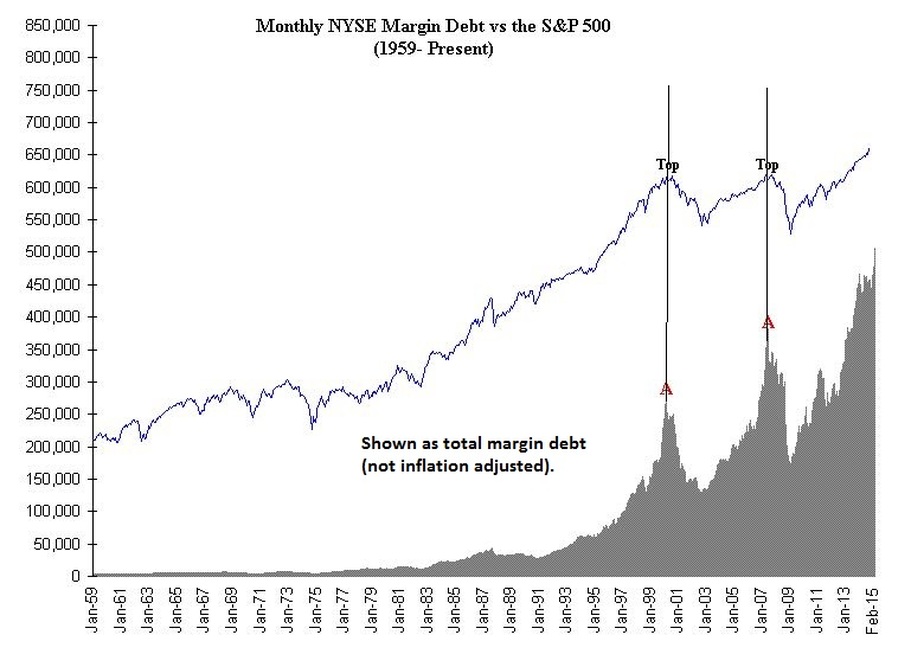

A large part of the expected declines in bear markets hinges upon how "expensive" markets were when the bear market begins. In this measure, we have a long way to fall given the overvaluation at the market peak.

We illustrate the recent market overvaluation via 3 charts produced by Crestmont Research (as of 01 July 2024 with data from 1871-to-Present). While it is not necessary to understand exactly how the data is plotted, it is important for every investor to realize where current valuations stand relative to this 153 years of history.

In the following graphs note the following: